By: Aaron Wall, CFA

Partner, Portfolio Manager

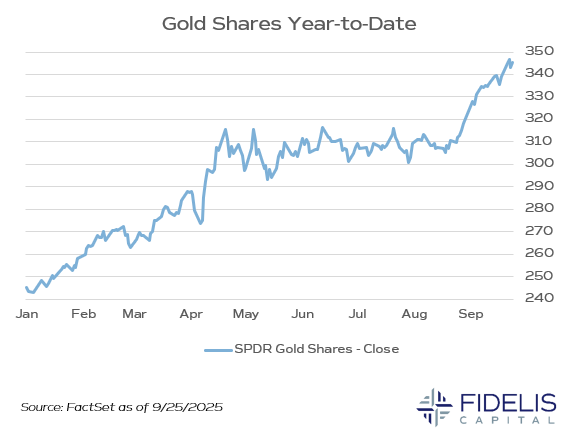

This year, gold has been one of the strongest performing assets across the market. Often viewed as the most traditional hedge, gold tends to be uncorrelated to equities and rises in times of stress.

With equities delivering strong returns this year, what has been driving these strong returns in gold?

For starters, the weaker dollar has been a plus. Policy uncertainty has also increased global demand for gold, specifically among global central banks. The World Gold Council estimates that gold is now held as 26.8% of global currency reserves, underscoring its traditional use as a non-dollar currency hedge. Also, US fiscal deficit stress and fears about the Fed’s ongoing independence continue to manifest into higher prices for gold.

With so many of these issues still unresolved, paired with an administration set on keeping the globe off balance, we expect gold to remain a valuable tool for portfolio diversification.