Combined, these factors have caused abrupt movements in global equities and fixed-income markets, with investors selling risk assets and seeking relative safety in U.S. Treasury markets.

Equity Markets Overview

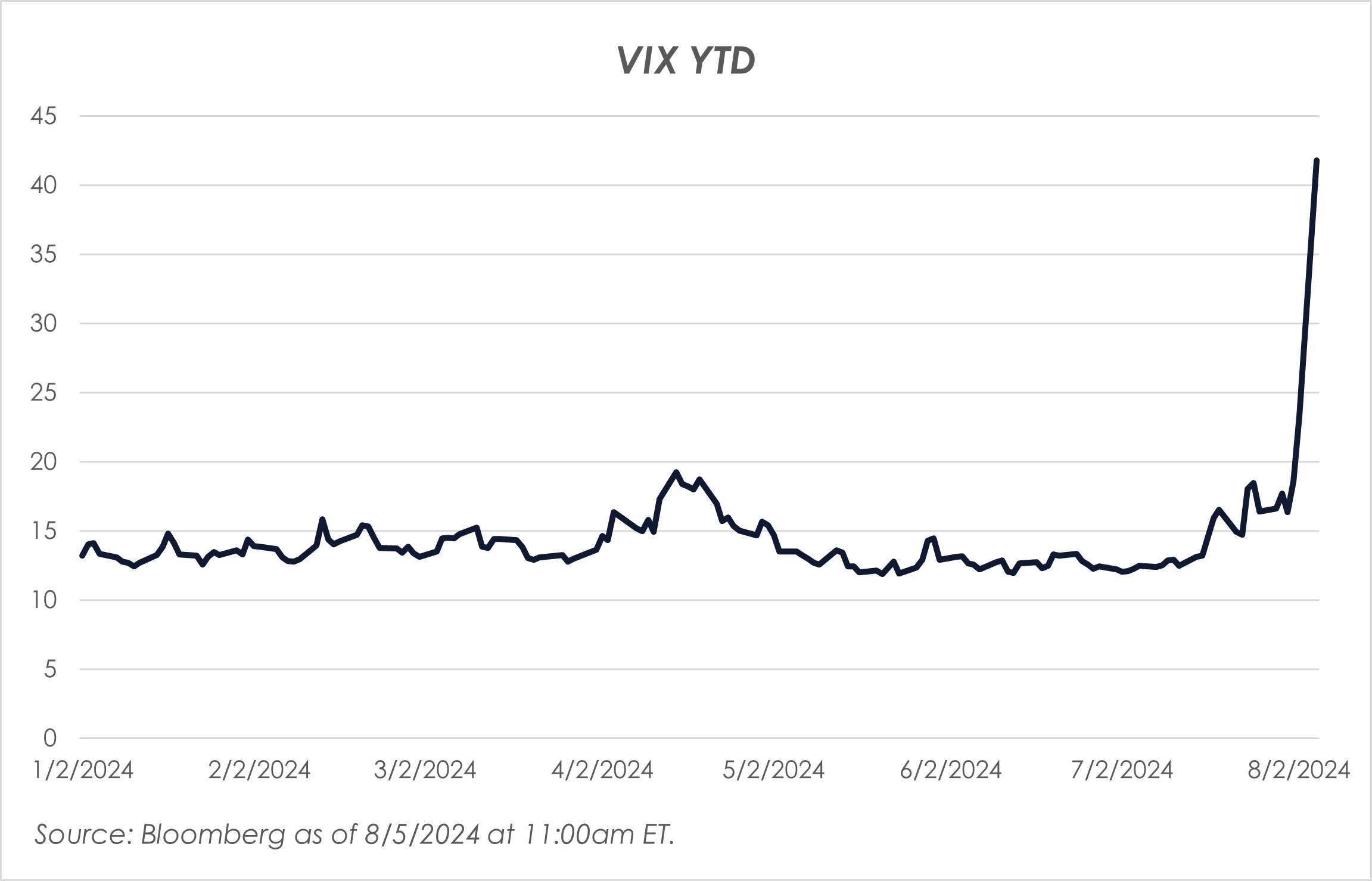

On Monday, U.S. equity markets opened sharply lower, with the S&P down over 4% and the Nasdaq down over 5%. International markets also suffered, with the Nikkei down over 12% overnight and European markets deeply negative. The VIX, a measure of market volatility, spiked to levels not seen since spring of 2020.

Fixed-Income Markets Overview

In fixed-income markets, Treasury yields saw a dramatic decline, with the 10-year Treasury hitting 3.66% in early morning trading, a new low for 2024. Markets are now pricing in a 0.75% reduction in the fed funds rate before the next FOMC meeting on September 18 and near-term inflation expectations that are much lower than the Fed’s 2% target rate.Current Volatility

Volatility is a natural part of the market cycle and can be healthy, providing a reset and eliminating excesses. The market was overdue for such a correction. Recent U.S. economic data suggests the economy may be slowing faster than expected, raising concerns that the Fed has kept interest rates too high for too long. The Fed has stated that they are less reliant on single data points and will most likely not react intra-meeting to the current volatility, having just met four working days ago. These factors have contributed to the global sell-off of risk assets.Our Portfolio Positioning

From a portfolio perspective, we've been preparing for increased volatility in the second half of 2024. We have stayed neutral in risk, maintained a balanced approach between stocks and bonds and focused on high-quality, high-free-cash-flow companies. While recent declines in equities are concerning, our prudent risk management over the past several quarters means our clients are not overextended. Fixed income has been the beneficiary of this recent volatility. The total returns for high-quality fixed income are decidedly positive over the last two days. In the past weeks, we have been positioning portfolios in higher-quality assets and longer-duration assets, which have performed well.Key Takeaways

Volatility also presents opportunities. Market pullbacks often create long-term buying opportunities. For clients holding cash, we are actively seeking attractive areas for long-term investment. However, we believe the market is still working through an overdue corrective cycle, and these technically driven sell-offs may take weeks or months to reverse. In fixed income, the heightened volatility and market reaction may be a bit overdone, which will also present opportunities in areas like lower-quality bonds and non-Treasury assets. Despite short-term market fluctuations, it's important to stay focused on long-term objectives.As always, we are here for you. Please reach out to your Fidelis Capital team with any questions.