By: Aaron Wall, CFA

Partner, Portfolio Manager

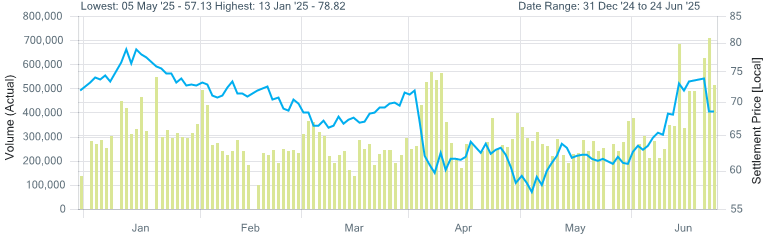

International trade and relations have been a focal point so far in 2025. Oil, as we would expect, has been incredibly sensitive to these changes. In the chart below, we can see oil prices dropped after April 2 (Liberation Day) as the market reacted to the potential for lower global growth from the surprise tariff proposals.

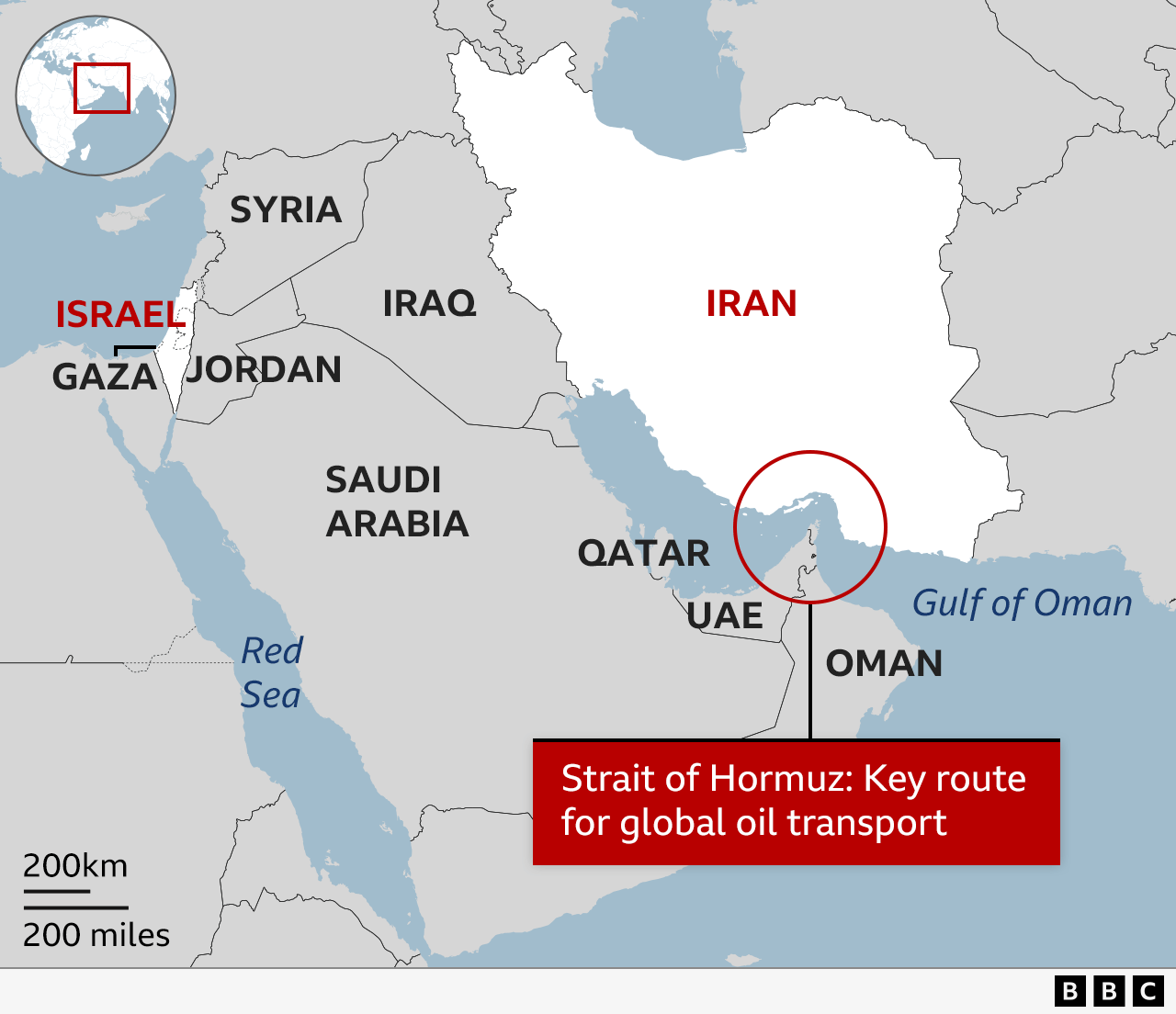

Oil’s next major drop followed escalating tension in the Middle East that led to the U.S. striking nuclear sites in Iran. Oil prices spiked as Iran threatened to close the Strait of Hormuz, a key artery for energy supply chains across the globe. Roughly 20% of the world’s liquified natural gas flows through the strait, which is also a critical route for oil and petroleum. For geographical context, we wanted to share this helpful map from the BBC.

A shutdown would cause significant supply chain disruptions and likely create an immediate supply shock within global energy markets. The U.S. has moved naval assets into the region to discourage this activity.

If Iran were to close the strait, energy prices would climb quickly. The U.S. economy is in a much stronger position than previous energy crises because it is a net exporter of oil. This would, however, complicate the Fed’s current stance on interest rates. The Fed is generally consistent in its discounting of more volatile inflation components, but spiking energy prices would put upward pressure on CPI.

Iran would also suffer major consequences. Energy sales have been a key source of revenue for the current regime and curtailing them would have an immediate, negative impact on their economy. Other countries in the region, Qatar for example, ship the majority of their exports through the strait. They would suffer similar economic consequences and effectively be pulled into the conflict.

Oil prices moved decisively lower after the ceasefire was announced on Monday night. De-escalation is critical in settling down global energy markets, and we’re monitoring developments closely as this latest geopolitical shake-up pans out.