There were some positive developments on the inflation front. Average hourly earnings, a proxy for wage inflation, came in lower than expected by 0.1%. What is the takeaway? The economy is showing some signs of slowing down, and inflation looks to be continuing its move lower.

This report will kickstart some volatility, which we have not seen in a few months, and we are watching closely. Note that we have been warning about the potential for higher volatility in the back half of the summer for some time and have been reflecting that in our work. As always, please don’t hesitate to reach out to your Fidelis team if you have any questions or concerns.

We’ll dissect the impact of these developments next week. Today, we are discussing a few themes that unfolded in July.

- Are small caps back?

- What about the rest of the market?

Small Caps Waking Up

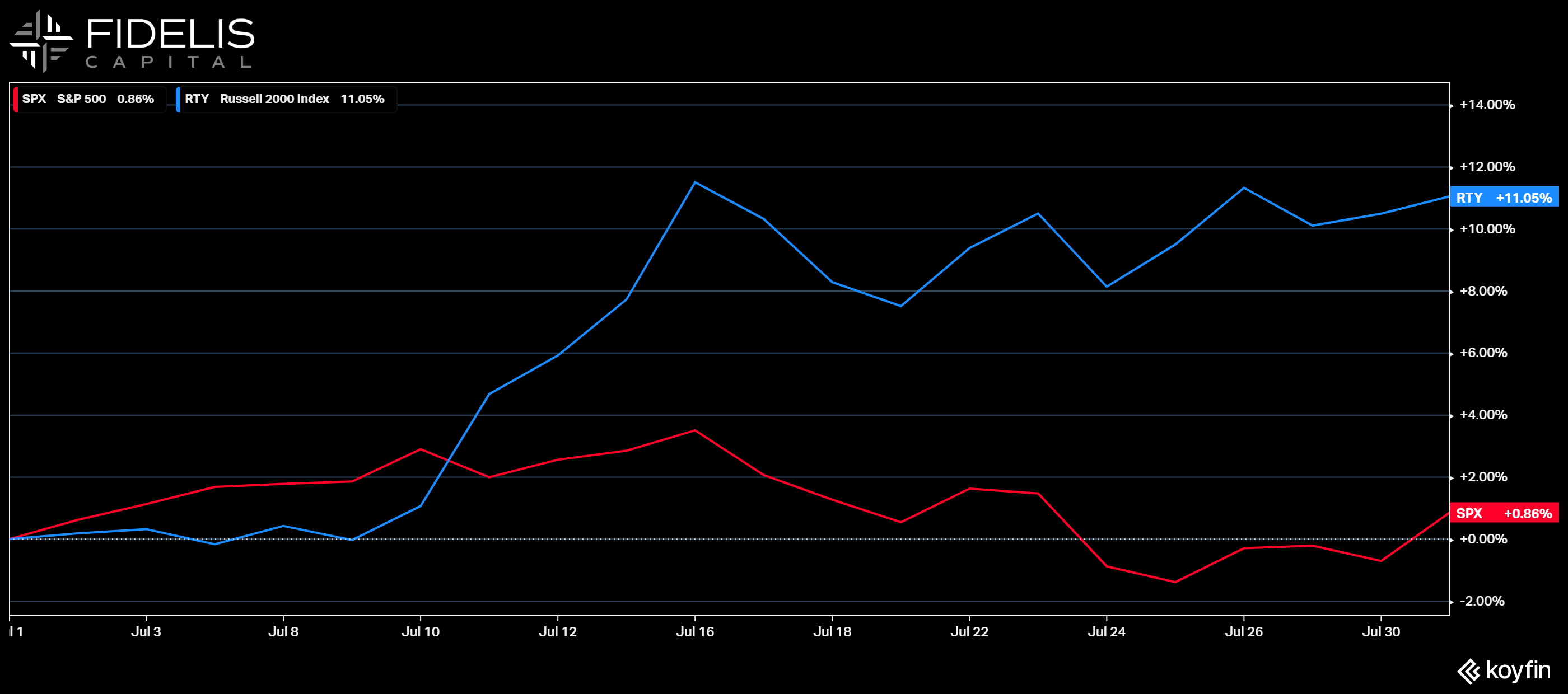

After spending the first half of 2024 weighed down by the effect of higher interest rates, small-cap stocks, as measured by the Russell 2000 Index, have started to rally meaningfully. Over the month of July, the Russell 2000 is up 11.1% against the S&P 500, which is up just 0.9%.

This chart illustrates the stark contrast in July performance between the Russell 2000 (blue) and S&P 500 (red).

This rotation underscores a few important points. First, inflation has improved and interest rate cuts are expected, which should bode well for small caps. Higher rates have traditionally been a headwind for small caps because they tend to hold more debt and their borrowing is more frequently at a floating interest rate.

According to analysis by Ronald Temple at Lazard, 45% of debt in the Russell 2000 is at a floating rate compared to 9% within the S&P 500, which means that when interest rate cuts begin, small caps should benefit. Additionally, approximately 40% of the companies in the Russell 2000 have not produced positive earnings over the last 12 months, which suggests the lower quality of earnings can leave the space vulnerable if volatility begins to increase.

Second, the Russell 2000 is less heavily concentrated in sectors like technology and communications, which have been the main underlying performance drivers of the S&P 500 year-to-date. Financials, healthcare and industrials are the largest three weightings in the Russell 2000.

Overall, our opinion on the small-cap space is turning more favorable, but we’d caution that the fundamentals of the space would need to improve to trigger longer-term relative outperformance. Rest assured, we are watching the trend closely.