The rest of the market also delivered earnings above expectations. As of Monday, 95% of S&P 500 had reported, and the blended growth rate was close to 13%. If you remember, companies revised earnings expectations lower right after Liberation Day. Now, the reported results are on track to nearly double those pessimistic forecasts.

The Latest from Chair Powell

As rate cut questions continue to swirl, Federal Reserve Chairman Jerome Powell added fuel to the fire during his press conference at the Jackson Hole Economic Symposium last Friday.Halfway through the prepared comments, he acknowledged an ongoing tariff theory as a reasonable base case: that they will cause a one-time shift in the price level. Said another way, tariffs will cause short-term volatility in inflation that is not likely to impact long-term inflation.

He also referenced the labor market and implied that the balance of risks for the Fed’s dual mandate is starting to shift towards supporting the labor market instead of countering inflation. In his own words:

“Putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago, and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.”

Strong earnings and accommodative monetary policy are bullish indicators for the market. It would be easy to argue that, given the strong recovery from April lows, the market has already priced in a better economic environment.

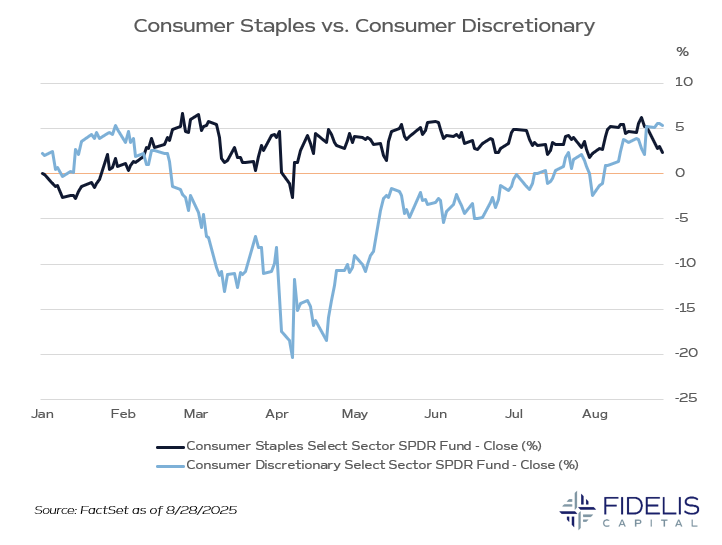

A way to measure this sentiment is to compare the performance of the Consumer Staples sector (Walmart, Costco, etc.) against Consumer Discretionary (Home Depot, Nike, etc.).

This chart, with Discretionary in light blue and Staples in navy, shows the YTD performance of ETFs that are comprised of each sector. It’s easy to see that Discretionary was the most impacted sector in April.

This month, the YTD performance for Discretionary actually flipped above the performance for Staples. This is an interesting signal, showing that the market is returning to a more risk-on approach as we head into the end of the year.

On the Docket: Fed Independence

Also in the news this week was the administration’s pushback against Federal Reserve Governor Lisa Cook. The president announced that he was going to fire her, and on Thursday, she sued the administration, challenging his definition of cause.The president does have the ability to remove a Federal Reserve appointee “for cause,” though there is no definition in the current law. This case is likely to move up to the Supreme Court and become a landmark case in relation to the Fed’s independence.

In a recent case, the Supreme Court defended the president’s ability to hire/fire, but it signaled that this may apply differently to the Fed. Either way, we are in for a legal battle that will directly test the Fed’s independence. This will be a closely monitored, highly impactful case, and we’ll be sure to share our commentary as the situation develops.