Partner, Portfolio Manager

This week kicked off with a Sunday afternoon video from Federal Reserve Chairman Jerome Powell responding to Justice Department subpoenas tied to his June 2025 Congressional testimony on the Fed’s headquarters renovation project.

This direct and public rebuke of the administration’s recent attacks on the Fed has been a long time in the making, leaving many expecting a volatile week ahead. Even with this start, the market managed an orderly week of performance. Let’s take a closer look.

What's Next for the Fed?

Many expected long-term interest rates (read: the 10-year Treasury) to gain some steam, but yields appear to be closing out the week within just a few percentage points of where they started.Some leaders in Congress were quick to push back against the Justice Department’s actions, with threats from both sides of the aisle to delay confirmation of the next Fed chair, which is set for May, if this process is not abandoned.

It’s important to note that although Powell’s term as chair is up in May, he remains a member of the board until 2028. It’s common practice for the outgoing chair to also resign from their board seat, but one has to wonder if Powell will continue to serve out his term to provide some stability in the organization given the recent pressures it has faced.

The Fed’s independence shifts back into the spotlight just as the Supreme Court is set to begin oral arguments next week over Fed Governor Lisa Cook’s potential dismissal from the board. This case will be incredibly important to determining how the Supreme Court will treat the Federal Reserve as a quasi-independent organization.

If all of this wasn’t enough fuel to the fire, the Fed holds its next meeting January 25-26. We’ll be following these developments closely.

Q4 Earnings Season Begins

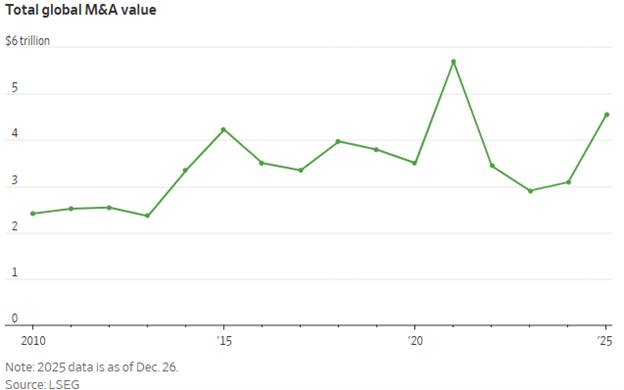

On the equity front, we are already starting Q4 earnings season. Institutional banks, as per the norm, kicked things off this week with solid releases. Goldman Sachs, Morgan Stanley, JP Morgan Chase, Bank of America, Citigroup and Wells Fargo combined to increase revenues by 6% for the full year of 2025, better than any previous year on record.A big driver of this increase, and an important signal to the broader market, has been an increase in dealmaking from their investment banking and trading divisions. Global mergers and acquisitions volume finished the year strong after sluggish levels in the three years following the pandemic boom, as seen in this chart from The Wall Street Journal.

Looking at 2026, reports indicated that these firms expect dealmaking to continue and the IPO market to start heating up. There is ongoing speculation that some of the largest privately held companies are considering going public, something that could provide a nice injection of fresh, new stocks for the index…and blowout fees for the investment banks.

As the sectors reporting earnings begin to broaden out over the next few weeks, we’ll be watching forecasts for 2026, commentary on existing geopolitical risk, and expectations for capital investments.

The overall forecast heading into earnings season is for an 8.3% YOY growth rate, which would mark the 10th consecutive quarter of YOY earnings growth from the index. Outsized earnings can serve as strong fuel for bull markets, especially if they continue to broaden outside of just the Technology sector—stay tuned.