Partner, Portfolio Manager

This week, we’re taking a break from earnings season to focus on major developments unfolding around the world.

Global interest rates in developed economies, after spending a decade-plus at ultra-low levels, are pushing back to more historically normal levels. This means that they are providing more useful signals and a renewed lens into how markets are interpreting geopolitical change. Let’s start with an extreme example, Japan.

Japanese Bond Yields Jump on Snap Election

In 1990, Japan had the second-largest GDP in the world. A robust economy, paired with the yen being a favored international currency, led to material growth in the 20th century.A series of missteps taken to avoid a significant recession in 1990 left Japan in a low-growth and low-inflation environment at the turn of the century. The Bank of Japan (Japan’s Federal Reserve) embarked on what would later be referred to as quantitative easing to stimulate the economy. This led to considerable expansion of the BoJ’s balance sheet and a long period of rock-bottom interest rates.

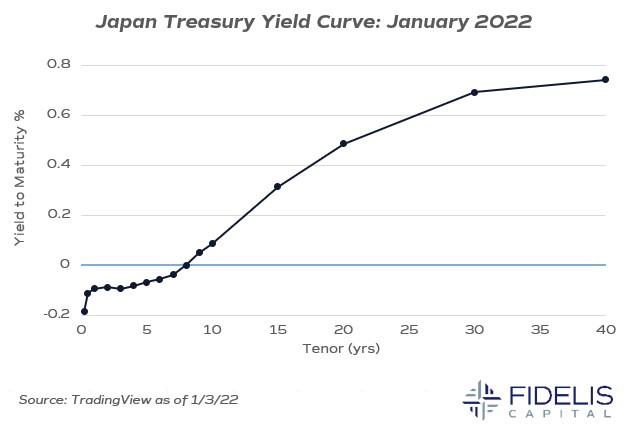

The above chart is the yield curve for Japanese government bonds (JGBs) in January of 2022. More than 20 years after its quantitative easing journey began, Japan remained stuck with low interest rates and had accumulated a debt-to-GDP ratio of 248.3%. For reference, the US began 2022 with a 121.9% debt-to-GDP ratio.

As seen in the chart, there were times in this period where short-term JGBs would carry a negative interest rate, meaning that investors were actually paid to borrow the money. Quite the experiment.

Inflation in Japan began to increase in 2022, in line with the rest of the world, so this yield curve began to normalize. Fast forward to today and Japan’s curve looks more traditional than it has in some time.

This week, Japan’s new prime minister, Sanae Takaichi, took a big jump and called a snap election in an attempt to take advantage of high approval ratings and strengthen coalition numbers. As part of this move, she also announced a tax-cut proposal to rally voter support at the polls.

The Japanese bond market reacted quickly to this news, sending long-term JGB yields higher, a reflection of nervousness that Japan was returning to a deficit-spending focus anchored with government borrowing. It will be important to monitor how this unfolds over the next few weeks.

Deficit Spending Concerns, Global Bond Markets & Greenland

Other bond markets have also displayed similar reactions to deficit spending. In 2022, the UK saw a spike in long-term bonds after a proposal to cut taxes. France experienced a similar spike last year due to concerns about the path of its politics. So why focus on these markets?This past weekend, President Trump announced that select European nations he perceives to be standing in the way of a US acquisition of Greenland will be issued additional tariffs.

This has become a familiar pattern. Fire an opening salvo of tariff threats over the weekend, stomach some volatility in the markets early in the week, then work towards a more agreeable position.

Markets opened lower after the federal holiday on Tuesday, and the most followed move was… you guessed it: the 10-year Treasury climbing higher.

As a reminder, the 10-year Treasury is important because many of the interest rates we (as consumers) pay are tied to this number. Consumer loans, student loans and, most importantly, mortgages. Watching these rates, which are wielding influence over policymakers, will be critical as global markets continue to be eventful in 2026.