This week, we thought it would be useful to cover:

- June CPI report

- Revisiting the other part of the Fed's mandate: Full employment

June CPI Report

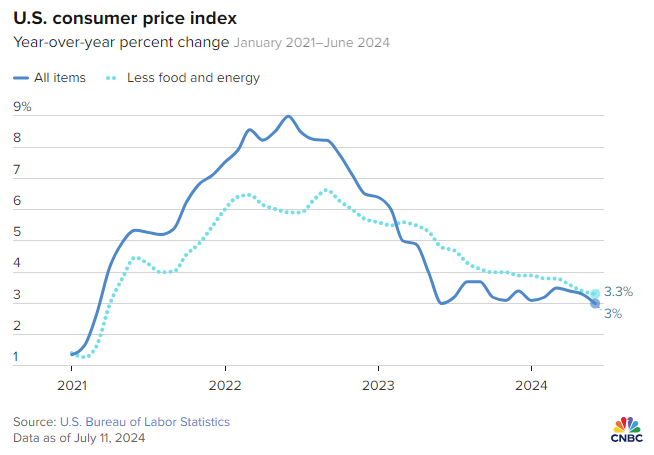

The June 2024 CPI report, released this week, indicated a 3.0% increase in the Consumer Price Index (CPI) over the past 12 months. Notably, core inflation, which excludes food and energy, rose by just 0.1% in June, marking the smallest increase since August 2021. Let’s take a look at how the current state of the labor market could also influence the Fed.

Revisiting the Other Part of the Fed's Mandate: Full Employment

The Federal Reserve has garnered significant attention the last several years amid its ongoing battle with inflation—and for good reason. Inflation surged to 40-year highs, forcing the Fed to raise rates 11 times between 2022 and 2023.During this recent period of higher inflation, it's important to remember that the Federal Reserve has a dual mandate: promoting full employment and maintaining stable prices. Recall the 14.8% unemployment rate in April 2020 during the COVID-19 pandemic. This spike highlighted the severity of the economic downturn and was a contributing factor in the Fed’s decision to cut interest rates to zero.[1]

What constitutes full employment? The Bureau of Labor Statistics says it’s the highest level of unemployment in the economy that doesn’t increase inflation. According to the Center on Budget and Policy Priorities, that number is typically associated with an unemployment rate of 4-6%.

In summary, full employment seeks to strike a balance where unemployment is low enough to utilize available labor efficiently, but high enough to prevent inflationary pressures. Meaning, there is no prescriptive level that defines full employment, and probably for the better. It leaves the Fed with enough room to move in the face of a weakening labor market.

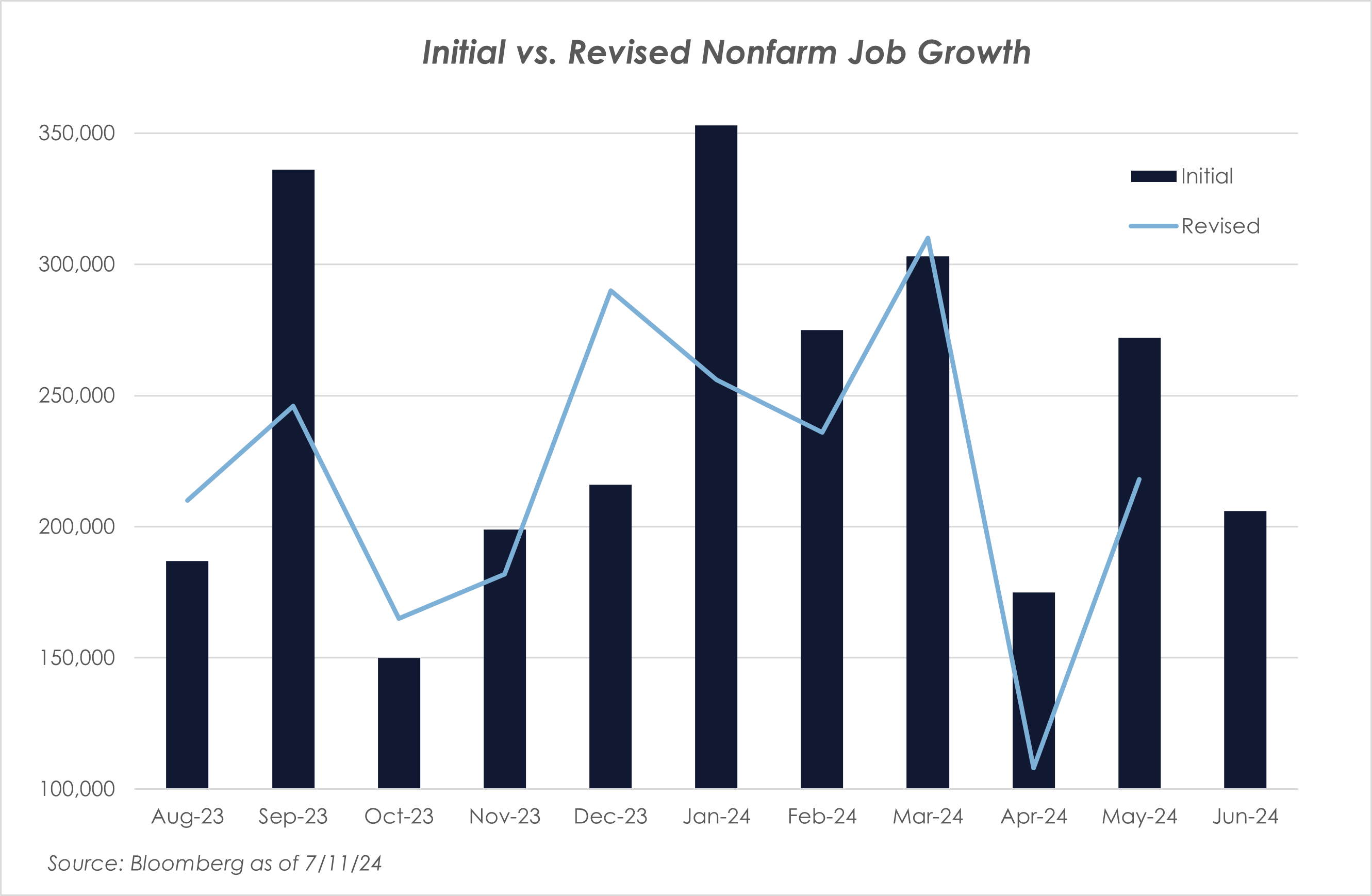

Last Friday's jobs report shed more light on the current status of the U.S. labor market. The report revealed that the U.S. economy added 206,000 jobs in June, while also nudging the unemployment rate up to 4.1%. As previously noted, 4.1% remains within the generally accepted range for full employment, and the addition of 206,000 jobs exceeded analyst expectations.

A closer analysis of the data reveals a mixed picture. The unemployment rate is now at its highest level since November 2021 and has risen in each of the last three jobs reports, indicating potential challenges in the jobs market. Furthermore, the downward revisions of April and May's jobs reports, by a total of 111,000 jobs, suggest that job growth was not as robust as initially reported.

While a reported 206,000 jobs were created in June, approximately one-third of these were government jobs. This reliance on government employment suggests that the private sector's job creation was relatively modest and that the report potentially overstated the strength of non-public sector hiring. Additionally, wage growth has slowed to its lowest pace in over three years.

In summary, while job creation continues, the rising unemployment rate, revised job growth figures, dependence on government jobs and slowing wage growth all signal underlying weakness that warrants close attention.

So, how do we translate this data? In isolation, none of these data points are overly concerning. Together, they suggest a labor market that has recently weakened.

While there has been notable progress in slowing the growth rate of inflation, it remains above the Fed's self-imposed target of 2.0%. However, the other half of the Fed's dual mandate is to ensure full employment. With the rising unemployment rate, downward job report revisions and slowing wage growth, the labor market shows signs of potential weakening.

How does this affect the Fed and its future interest rate decisions? The Fed must assess: what are the economic implications of a weakening labor market, and does a weakening labor market push them to cut interest rates despite not reaching their 2.0% inflation target. Decisions will likely balance getting inflation to a level the Fed is comfortable with while also making sure the labor market is supported. If the job market continues to soften, the Fed might prioritize economic support through rate cuts, despite not reaching its inflationary goal.

When will the Fed cut rates? This is the most pressing question facing today’s market. While there has been significant focus on inflation data, it is equally important to monitor both inflationary and jobs data. Together, these indicators will provide a fuller picture of the factors the Fed will consider when deciding to cut rates.