Markets react quickly and, in this case, violently to new information in an attempt to interpret how it will impact the business environment moving forward.

As we’ve discussed previously, this type of policy takes longer to impact the economic data (often referred to as the “hard” data).

This week, we received an updated Consumer Price Index (CPI) report for June that finally revealed early impacts of trade policy on inflation.

Inflation Rises in June

Per June’s headline CPI number, inflation rose by 2.7% over the last 12 months. This is a notable acceleration from May’s 2.4% annual increase. The move higher in June matched market expectations, which had been pricing in June as the first report to show tariff policy impacts.On its face, this is a negative development—inflation has crept back to levels not seen since the start of the year. The Wall Street Journal highlighted the increases in areas where products are typically imported:

“Food prices rose 0.3% despite a 7.4% decline in egg prices. One culprit was fresh fruit and vegetables (1%), the biggest increase in more than a year. About 60% of fresh fruit and 35% of fresh vegetables are imported. …Prices for coffee—almost all of which is imported—rose 2.2%.”

Unfortunately, policy volatility is likely to continue for the foreseeable future after President Trump’s administration extended the tariff negotiations deadline to August 1.

This will be the key question: are producers going to absorb some of the impact by compressing their margins, or are they going to just pass the cost directly to consumers? The answer to this question is likely to vary based on the good/industry, but we should start to get a better idea once we have a few months of data to review.

Markets Shrug It Off

Given our experience with key CPI reports over the last few years, it would be normal to expect some increased market volatility after the June reading. Markets, however, shrugged off this report for a number of reasons.First, an increase in inflation was expected by the market, which understood this report would likely highlight an increase in inflation.

Second, the “stickier” components of inflation showed signs of improvement. Shelter, a component we’ve discussed at length, is the largest weighting in the CPI calculation. Shelter is slower to adjust to inflationary trends due to lags within rental markets (e.g., 12-month leases), and the pace of housing market activity is generally slower.

Shelter was up 0.3% in the May report and fell by 0.1% to 0.2% in the June report. Stability in this component is critical because it tends to move in a trend and be less volatile in the short run. We’re keeping a close eye here as tariffs on construction-related inputs will take additional time to work into the numbers.

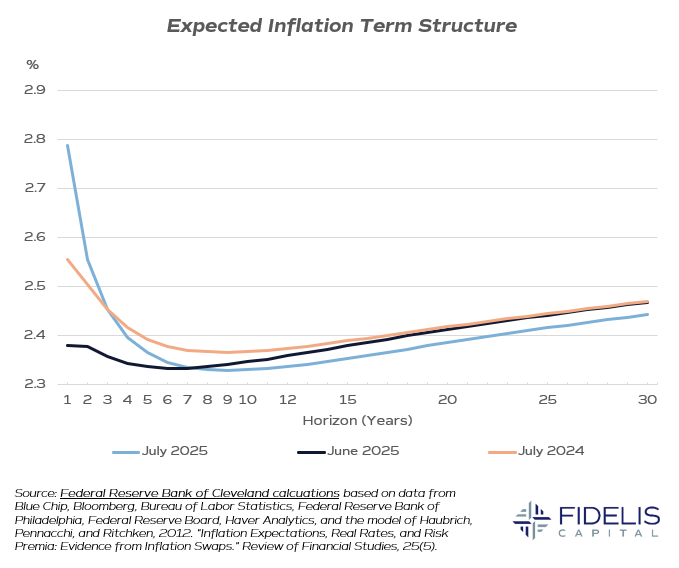

The third reason is that inflation expectations remain well anchored. The chart below shows the inflation expectations for the next 30 years.

Source: The Federal Reserve Bank of Cleveland

We can see that the market is expecting short-run inflation to be elevated over the next 12-24 months because of this policy uncertainty, but the long-run expectations are closer to the Fed’s stated 2% target. Long-run expectations are critical; they signal that the market continues to trust that the Fed will be able to handle the task of navigating monetary policy through this heightened uncertainty.

Speaking of the Fed, this report continues to complicate its path forward regarding interest rates. We noted recently that two key, typically hawkish Fed governors, Waller and Bowman, have been in the press advocating that tariffs will be transitory and the Fed can look past them to resume cutting interest rates.

This does not seem to be a consensus opinion, and the June CPI report highlights the Fed’s current predicament. Inflation will not be improving over the next few months, so can it justify stimulative policy? This report may underscore that the data-dependent Fed will be more comfortable with a wait-and-see approach throughout the summer.

We’ll be keeping a close eye on the labor market for clues about how the Fed may proceed. It seems that if tariffs weren’t in the equation, the Fed would be comfortable resuming interest rate cuts. Weakness in the labor market could force its hand, but as long as jobs numbers remain orderly, the Fed will likely continue its cautious wait-and-see approach.