Next week, our Q3 Market Outlook Webinar will be released. Investment Committee members will review the economy, stocks and bonds over Q2, address some more specific themes, such as the election, and cover our outlook and positioning for the second half of the year. We look forward to sharing that with you soon.

The Bar is Set Even Higher for Q2 Earnings

Second quarter earnings season started last week with announcements from major banks like JPMorgan Chase, Wells Fargo and Citigroup. Recall that stronger-than-expected first quarter earnings provided a positive boost to the market as we entered the summer. Optimistic earnings projections for the rest of the year remain a major driver as to whether the market will continue trading near all-time levels.In the May 24 edition of Investment Insights, we reviewed our key takeaways from Q1 earnings, with one of the featured points being a potential weakening of the U.S. consumer, at least in the lower income ranges. Since then, we’ve received some mixed data points around the state of the consumer.

Retail sales in June were better than expected and headline inflation reached its lowest growth level in almost three years, yet U.S. consumer sentiment has dropped to its lowest level in eight months. We are closely watching the results from more value-oriented retailers, like Costco and Walmart, compared to companies tied to more discretionary spending. A widening in the performance gap between these two groups would suggest a broadening economic divide between low-wage earners and the rest of the economy.

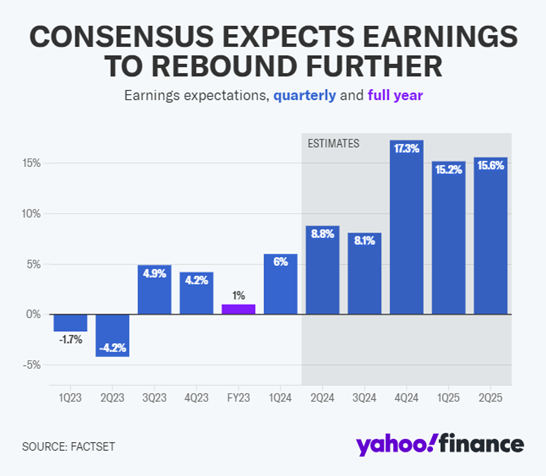

Expectations for this earnings season are optimistic. According to FactSet, estimated earnings are projected to be 8.9%, which would be the highest year-over-year growth rate since Q1 2022. Earnings growth is also expected to be broader than Q1, with communications, health care, technology and financials all projected to report double-digit year-over-year gains. Furthermore, nine of the 11 S&P sectors are expected to be positive.

Looking beyond Q2 to the end of 2024, strong earnings are expected to continue in Q3 and Q4, at 8.1% and 17.3%, respectively.

In summary, this should be a relatively positive earnings season and should underscore the strength of the U.S. economy.