If you haven’t already, listen through the link here. Along with other Investment Committee members, we review the economy, stocks and bonds over Q2, address some more specific themes, including the rising U.S. deficit, and cover our outlook and positioning for the second half of the year.

Election Season Heats Up

The U.S. presidential election is in just over 100 days, and it has already proved to be one for the history books.From trials and debates to an assassination attempt and this week’s decision by our sitting president not to seek re-election, there has been no shortage of drama in the 2024 election cycle.

How should we prepare ourselves as investors for what could be a chaotic couple of months? First, we should expect more volatility.

In a “typical” presidential election year, volatility is elevated in the three months leading up to and the two weeks following election day. Interestingly enough though, volatility normalizes by year-end as outcomes are known and future policy becomes clearer.

This year, we are pulling forward some of that volatility into July, as the VIX (a measure of market volatility) has moved up from about 12.5 on July 1 to nearly 18.5 at market close on July 25.

The key takeaway is that we're entering a phase where stock market volatility may increase, though it will be relatively short-lived on a historical basis.

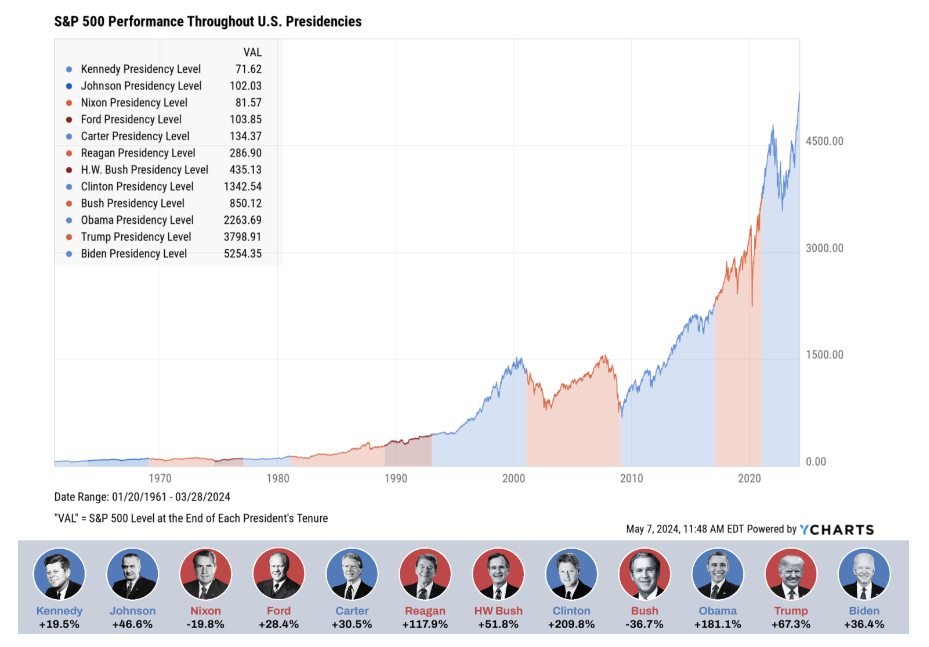

That said, avoid making abrupt changes to your portfolio in response to headlines, polls or even election outcomes. It's important to understand that the stock market tends to rise under both Democratic and Republican administrations.

Since 1960, there have been only two administrations that did not result in positive stock market performance: the Nixon administration in the 1970s and the George W. Bush administration in the early 2000s. This underscores the general resilience of the market over time, despite short-term political uncertainties.

While we encourage investors to maintain their alignment with long-term goals and objectives, we also recognize that policy changes can influence our approach to risk management within portfolios.

From a global perspective, we are aware of the implications of a change in trade policy. The countries that are most vulnerable, in our opinion, are China and Mexico, while India and Vietnam could be potential beneficiaries of any tech-driven supply chain realignment.

From a U.S. perspective, we are weighing the impact of trade, tax, spending and regulation changes on our view of sectors like energy (carbon vs. clean energy), infrastructure (government spending), healthcare (regulation), banking (taxes and regulation) and technology (trade and regulation).

We caution that while a lot is known at this point, there are still plenty of unknowns—three months can feel like a lifetime in an election cycle. We are intently watching the markets and potential outcomes.