2024 Mid-Year Report Card: So Far, So Good

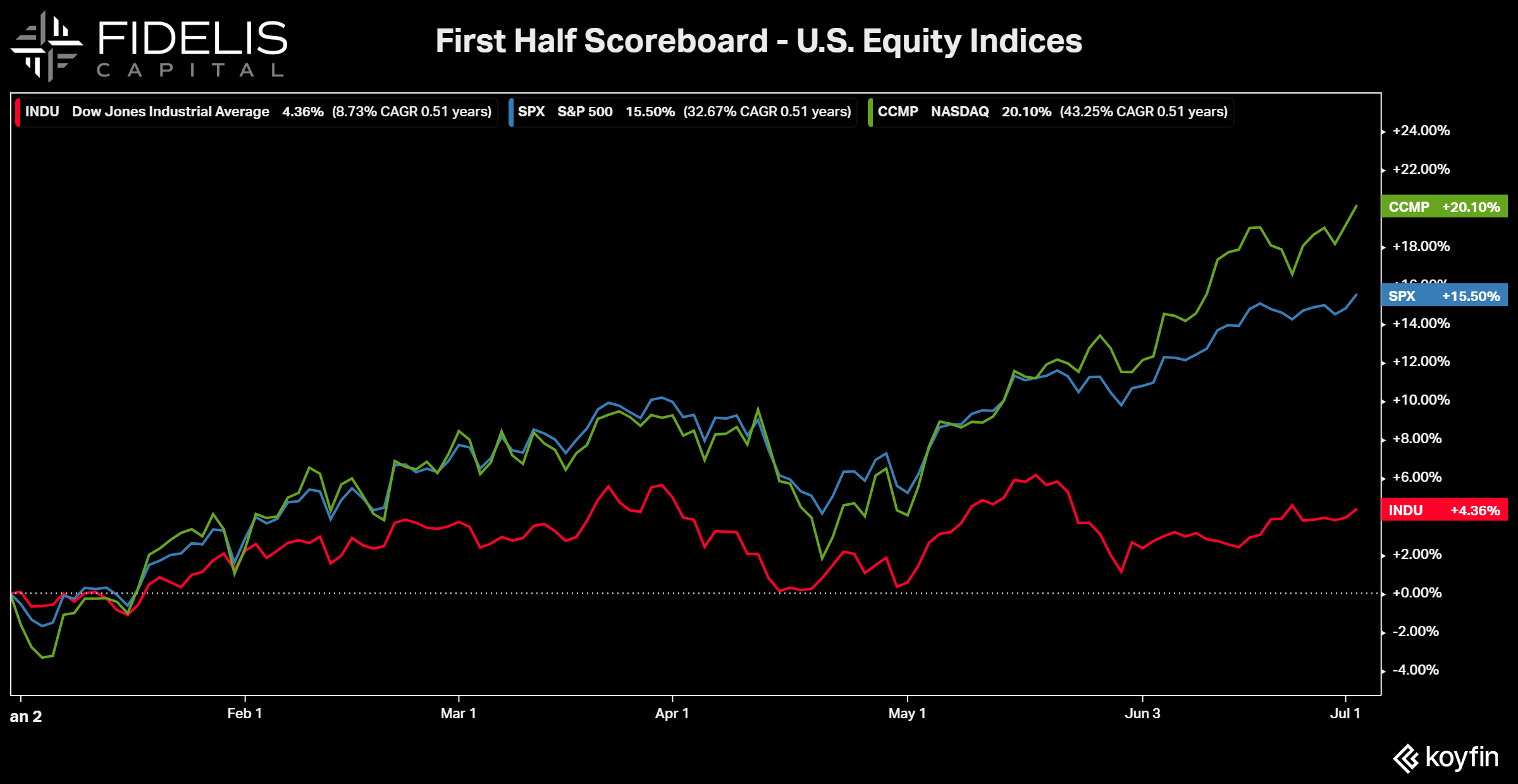

It was a positive first six months of the year for equity markets. The S&P 500 was up 15%, the Nasdaq 20% and the Dow more than 4%. The S&P 500 reached 31 new all-time highs thus far in 2024, and the YTD returns through June 30 represent the 13th best start for the S&P 500 since 1950—things have been good.

As we noted in the May 31 edition of Investment Insights, the equity markets have been so strong that it has forced at least a dozen Wall Street firms to upwardly revise their year-end S&P projections. What has fueled this rally? Well, several things.

First, earnings from S&P 500 companies were better than expected in the first quarter. Reported earnings came in at 6% YOY, the highest growth rate since Q1 of 2022, according to FactSet. Better still, earnings are expected to strengthen as we progress through 2024, with full-year estimates looking for about 11% annualized growth.

Second, inflation is continuing to slow down. The most recent reads on CPI, core CPI and PCE were all lower than analysts’ expectations. Looking at Fed fund futures, an investment instrument used to price the probability of Federal Reserve interest rate cuts/hikes, the market is anticipating two interest rate cuts by the end of the year. These expectations are a far cry from the six cuts projected at the beginning of the year, but they still convey the sentiment that the market is expecting a more accommodative Fed moving forward.

Lastly, the economic data has been largely supportive of a “soft landing” scenario. Real GDP has been positive, the U.S. consumer has been resilient and the unemployment rate remains low at 4%.

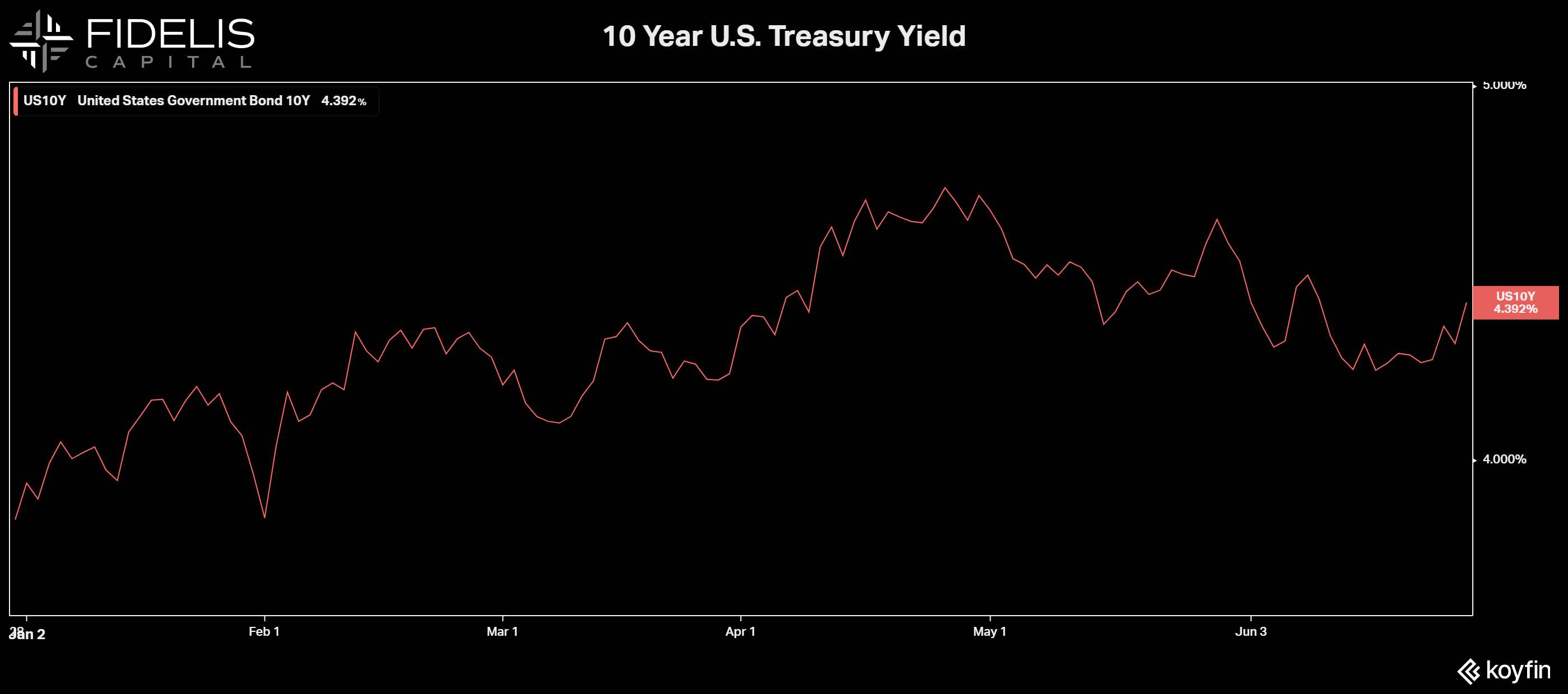

The fixed income markets have proven to be more volatile this year, while also presenting attractive entry points for yield- and income-oriented investors. The 10-year Treasury started the year at 3.86% and peaked in late April at 4.70% before settling in at 4.39% at the close of June. We expect rates to remain somewhat volatile over the remainder of the year as markets digest inflationary data, attempt to decipher future Fed policy and gauge the election implications for key areas like spending, taxes and trade.

What does all of this mean for the second half of 2024? We would expect some volatility in Q3 given the market’s surprising surge in the first half of the year. That being said, volatility is part of a healthy, functioning market. If history serves as a guide, we should expect the market to be higher as we approach year-end.

According to a study conducted by Comerica, the S&P 500 has registered gains in every presidential re-election year since 1944, with the second half of the year producing the strongest returns. When looking at the S&P 500 on the whole since 1990, there have been 10 occasions where the index returned 10% or greater in the first half of the year. In each instance, the index went on to average a 10.8% return in the remaining six months.

As we enter the back half of 2024, we continue to focus on inflation and Fed policy, the health of the U.S. consumer, rising geo-political risks and the potential economic outcomes tied to the upcoming U.S. presidential election. Because of these factors, we remain neutral in our outlook towards risk assets and advocate for a balanced approach within the confines of our clients’ investment objectives.