May CPI: No Signs of Tariffs Yet

The market had anticipated a 2.4% year-over-year increase, and the report matched those expectations. Shelter, one of the stickiest components of inflation, remained at 0.3% for the month. Energy prices fell in May, while food prices increased.It’s clear that tariffs are not yet reflected in the hard data, though it is still early days. It’s important to remember that the hard data (e.g., CPI, employment and GDP) will not react with the same volatility as broader markets. These key metrics will reflect the impact over months, not days, so we’re watching how they evolve through the rest of the year for insights into the economy’s response to trade policy changes.

Annual Inflation Progress

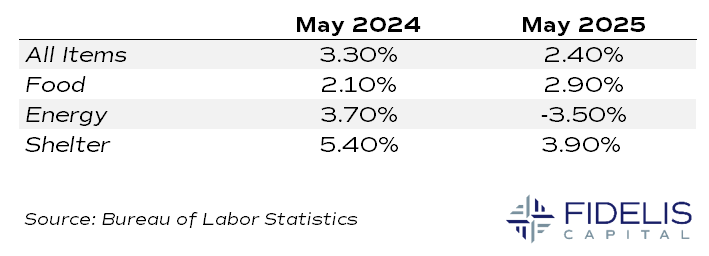

Compared to May 2024, the May 2025 inflation report shows meaningful progress toward the Fed’s stated 2% target. The table below shows the key highlights.

Starting with the negative, food prices have increased since this time last year. They have been more sensitive, and the increase could be attributed to a number of factors. Energy prices have declined meaningfully in the last 12 months, a welcome trend.

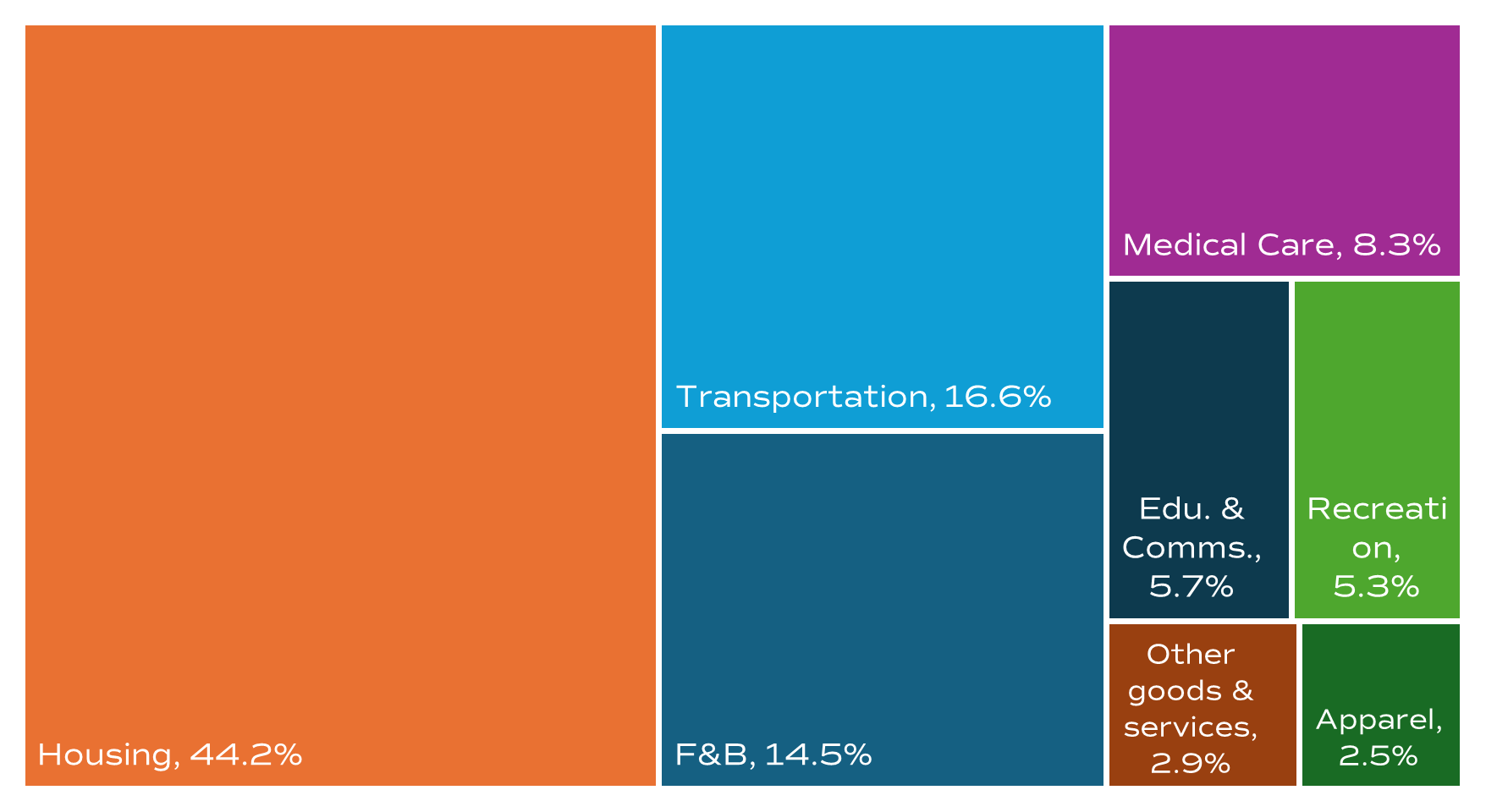

The most important factor in this index is shelter, which accounts for 44.2% of the CPI basket. It far outweighs other tracked prices of goods and services, as seen in the chart below.

The State of Housing

Rent and Owners’ Equivalent Rent have stabilized in recent months—two key variables that should not be underestimated. We’ve discussed before how they tend to move slower. Individuals don’t purchase homes often, and rents typically adjust on longer-term schedules due to the general term of leases being 12 months.This will be critical to monitor as we wait for the impact of tariffs on economic data in the next few months. If housing costs remain stable, it may support the case that tariff effects will be short-term, one-time price adjustments. If the tariffs start to lead to increases in housing, impacts to the inflation outlook may be more pronounced.

All of this is important as we look towards the Fed. It has signaled a willingness to continue cutting interest rates this year, but if it sees trends in the inflation data that suggest it may be moving higher in a sustained fashion, the Fed will likely think twice about easing policy in the back half of this year.