- Inflation Slows in May

- June FOMC meeting: Strong Jobs and Cooling Inflation

Inflation Slows in May

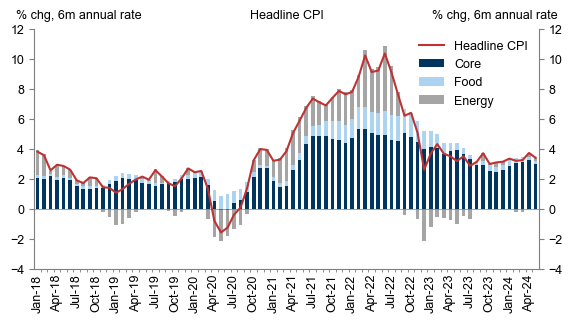

It was a busy week. We had both the release of May’s Consumer Price Index (CPI) report and the Fed’s June FOMC meeting.Wednesday’s inflation report was well received by the market, with headline CPI essentially flat at 3.3% on a year-over-year basis, its lowest reading in two years. For context, April’s reading was 3.4%. Core inflation, which excludes food and energy prices, came in at 3.4% YOY, the slowest gain since August of 2021.

A deeper dive into the data indicates that the slowdown in prices was relatively broad-based. Gasoline, car insurance (which, previous to this report, had been experiencing its biggest jump in cost since the 1970s), airfares and discretionary consumer goods spending all declined for the month. The shelter component remained stubborn, with a contribution of +0.4%.

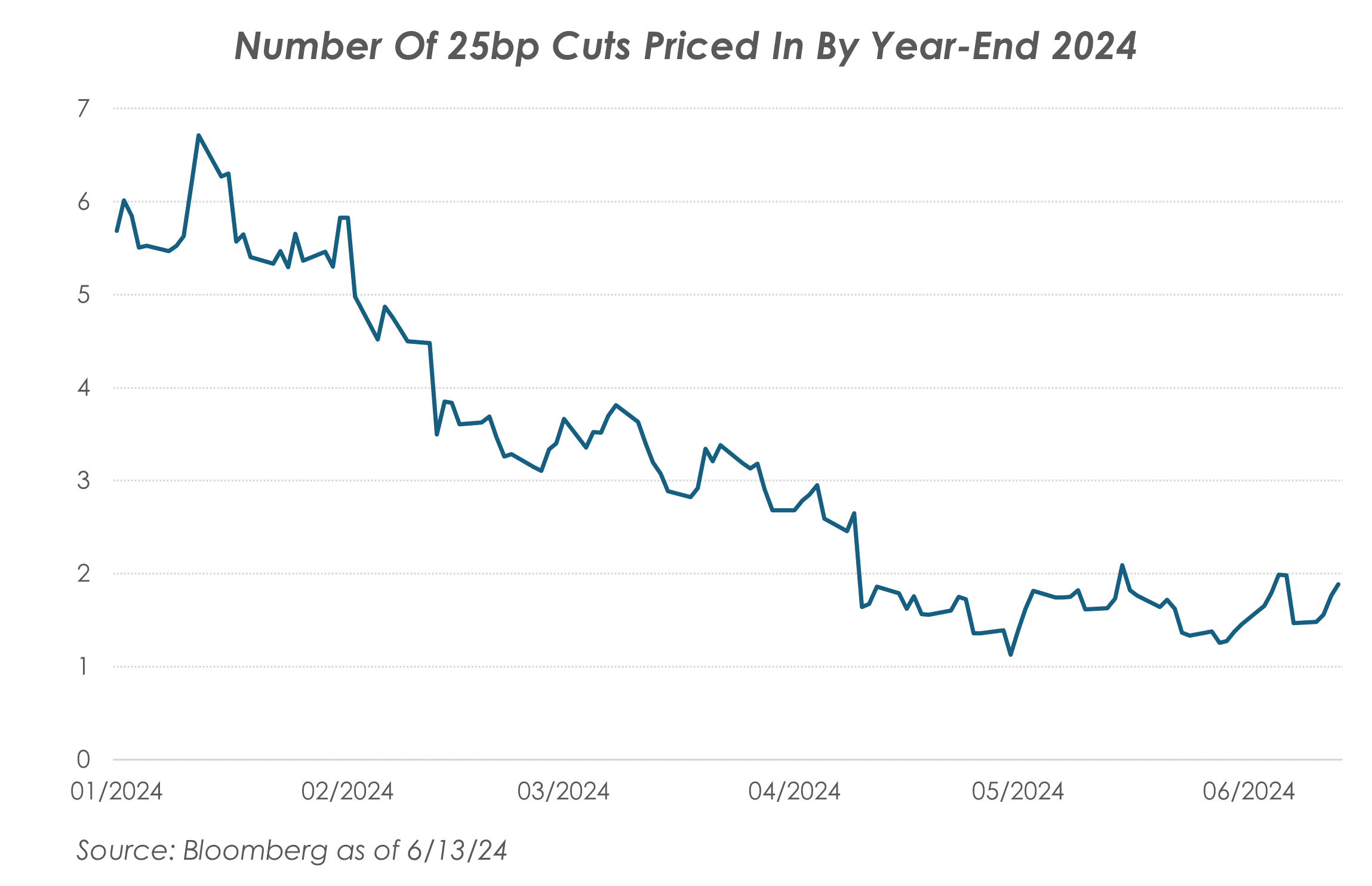

With cooling inflation across a number of components, this is the type of inflation report that is welcoming to those investors who want to see rate cuts sooner rather than later. It’s likely that the Fed will want to see a further deceleration in inflation before they eventually cut rates. Still, this report keeps both September and December cuts on the table, according to the most recent Fed funds futures data.

June FOMC Meeting: Strong Jobs and Cooling Inflation

The Fed voted to leave its policy rate unchanged at the conclusion of their June meeting, which ended on Wednesday.There have been conflicting data points for the Fed to digest over the past week. Last Friday’s jobs report pointed to a resilient labor market, with included stronger wage growth. Strong jobs and wages are considered a headwind for the Fed in its battle to reduce inflationary growth.

Wednesday’s CPI report provided the backdrop for a more dovish narrative as we enter the summer, with prices generally dropping in May.

Fed Chair Powell’s post-meeting commentary indicated that the Fed is in no hurry to raise rates in 2024. Remember, the Fed previously signaled it didn’t want to cut rates too quickly and risk a reignition of inflation as we head into the back half of the year and look toward 2025.

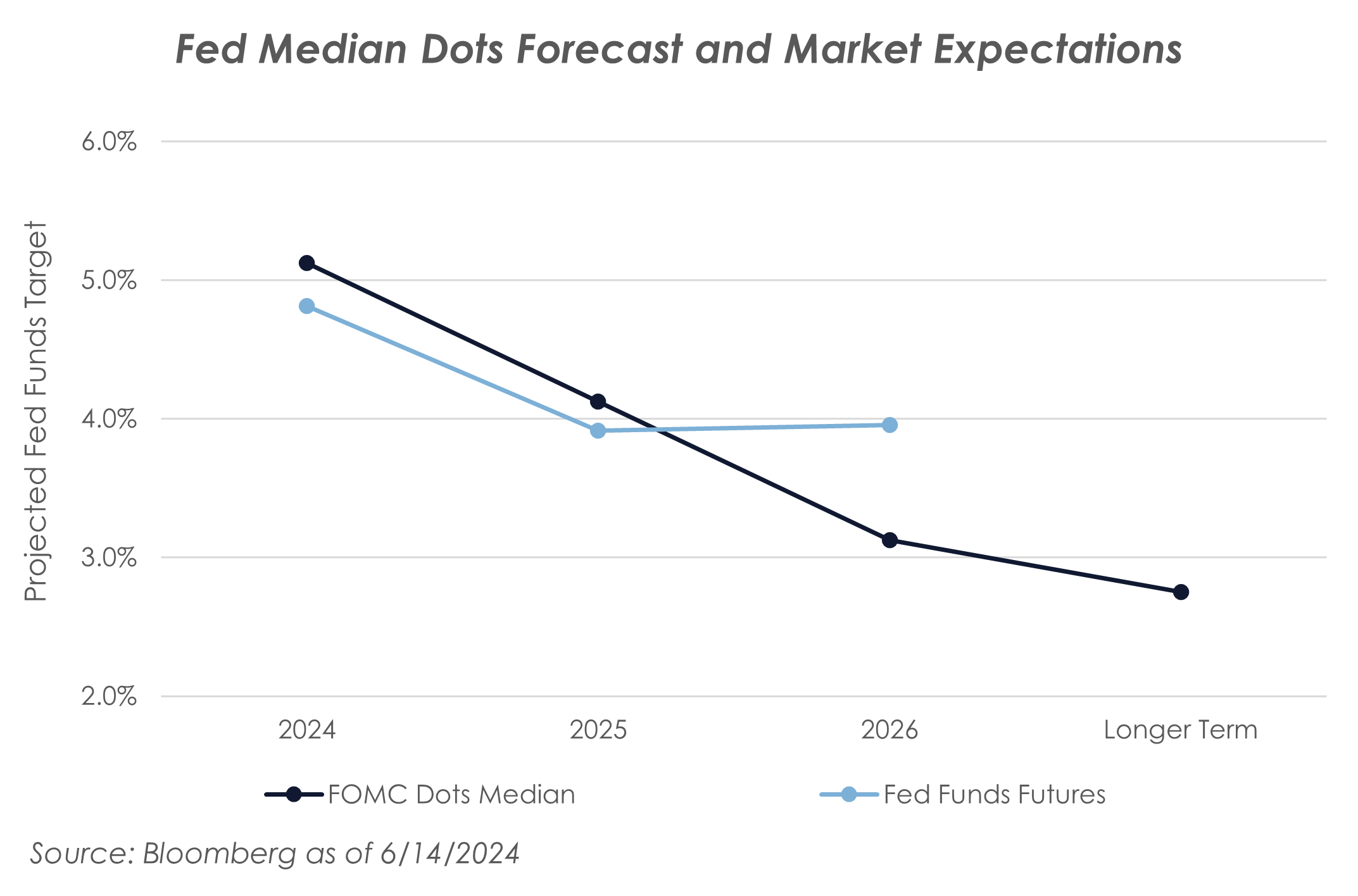

The Fed’s new dot plot reinforced this view, with committee members indicating that they only see one interest rate cut in 2024, followed by cuts totaling 100 bps in both 2025 and 2026. This is a change from back in March, when the dot plot indicated that the Fed was expecting three cuts in 2024.

What does this mean for financial markets? It’s logical to think the markets would be contemplating a “higher for longer” environment, yet equities rallied and yields dropped after Powell’s press conference. Investors seemed to embrace the idea of a “soft landing” scenario and the thought that the Fed is committed to cutting rates for the next two years.

The Fed has four more meetings this year, in July, September, November and December. The market is expecting two cuts, though the Fed is telling us it only sees one. This should make for an interesting summer. Stay tuned.