Does U.S. Stock Market Concentration Matter?

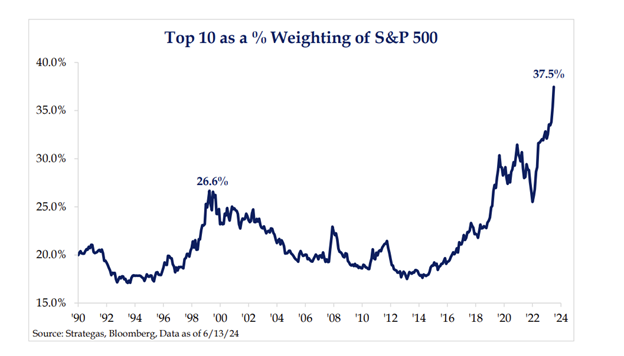

When we reference “the market,” we are typically referring to the S&P 500. We view this as the best proxy because it consists of the largest 500 stocks in the U.S. stock market. One important characteristic of this index is that it is market-cap weighted. This means that the larger the company, the larger its weight is in the index.Currently, the largest 10 stocks in the S&P 500 account for 37% of the index’s total market capitalization.[1] Drilling down further, Apple, Microsoft, and Nvidia made up over 20% of the index as of the end of May.[2]

Although it is becoming a more frequent topic of discussion, investors are often unaware of the concentration forming under the hood of the market. To put these numbers into perspective, the bottom 20% of the S&P 500 consists of 361 stocks.[3]

Should a narrow market be of concern to investors? Perhaps, but maybe not as much as one may initially think.

According to Strategas Research, the top 10 holdings of the S&P 500 account for 31% of the index’s total net income, have an average trailing profit margin of 26% and average annual earnings growth of 264%. These data points indicate it’s not just fear-of-missing-out (FOMO) and momentum driving mega-cap returns, but that there is an earnings growth story as well.[4]

This is a stark contrast to the dot-com bubble, which was the last time we saw heavy market concentration. In that instance, the S&P 500 traded at a price-to-earnings ratio (P/E) of 46.5. Today, it is around 27.5.[5] If we look at the NASDAQ, a tech-heavy version of the S&P 500, it traded at a P/E of 200, seven times today’s level.[6][7] During that period, tech stocks were (in many cases) money losers, contributing little to nothing to overall earnings.[8] In sum, concentration can be viewed as more justified in today’s market given the substantial earnings contribution of these larger stocks to the earnings of the overall market.

How does the U.S. stock concentration look relative to the rest of the world? A recent study by Morgan Stanley indicates that even after this increase in concentration, the U.S. is still not in the top five of most concentrated markets in the world.[9]

Morgan Stanley further states, “The U.S. Market, even after a decade of increasing concentration, remains one of the more diversified markets in the world.” Concentration is a global theme, and we still remain incredibly diversified given the massive size of our stock market.[10]

The main takeaway here is to understand the first rule of investing, which is to know what you are investing in. Investors, particularly those using index funds, should be aware that the S&P 500 has become increasingly concentrated around a cluster of companies that have grown so large, they are dominating the underlying market. We are watching this trend carefully, and though it is not ringing alarm bells just yet due to strong earnings from those companies, it is an important theme to monitor.

Closing Time

As always, we are here for you. Do not hesitate to reach out to your Fidelis Capital relationship team with any questions.[1] Strategas Research, “Investment Strategy – June 14”

[2] Barron’s, “After Apple Surge, Market Concentration Is Only Getting Worse”

[3] State Street Global Advisors – June 20, 2024

[4] Strategas Research, “Investment Strategy – June 14”

[5] MacroTrends, “S&P 500 PE Ratio – 90 Year Historical Chart”

[6] The Motley Fool, “Are Tech Stocks in a Bubble?”

[7] Morningstar – June 21, 2024

[8] Ideas.TED.com, “A revealing look at the dot-com bubble of 2000—and how it shapes our lives today”

[9] Morgan Stanley Investment Management, “Counterpoint Global Insights: Stock Market Concentration”

[10] Morgan Stanley Investment Management, “Counterpoint Global Insights: Stock Market Concentration”