Thus far, markets have not paid much attention to these developments—a welcome change from the volatility that rocked markets to start the second quarter.

Oil markets, however, have been responding in a more traditional way to the recent military action. We’ll start by digging into oil prices then unpacking what we learned from the Fed this past week.

Oil Prices Amid Geopolitical Escalation

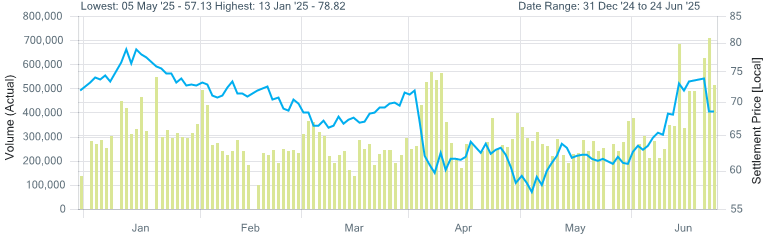

International trade and relations have been a focal point so far in 2025. Oil, as we would expect, has been incredibly sensitive to these changes. In the chart below, we can see oil prices dropped after April 2 (Liberation Day) as the market reacted to the potential for lower global growth from the surprise tariff proposals.

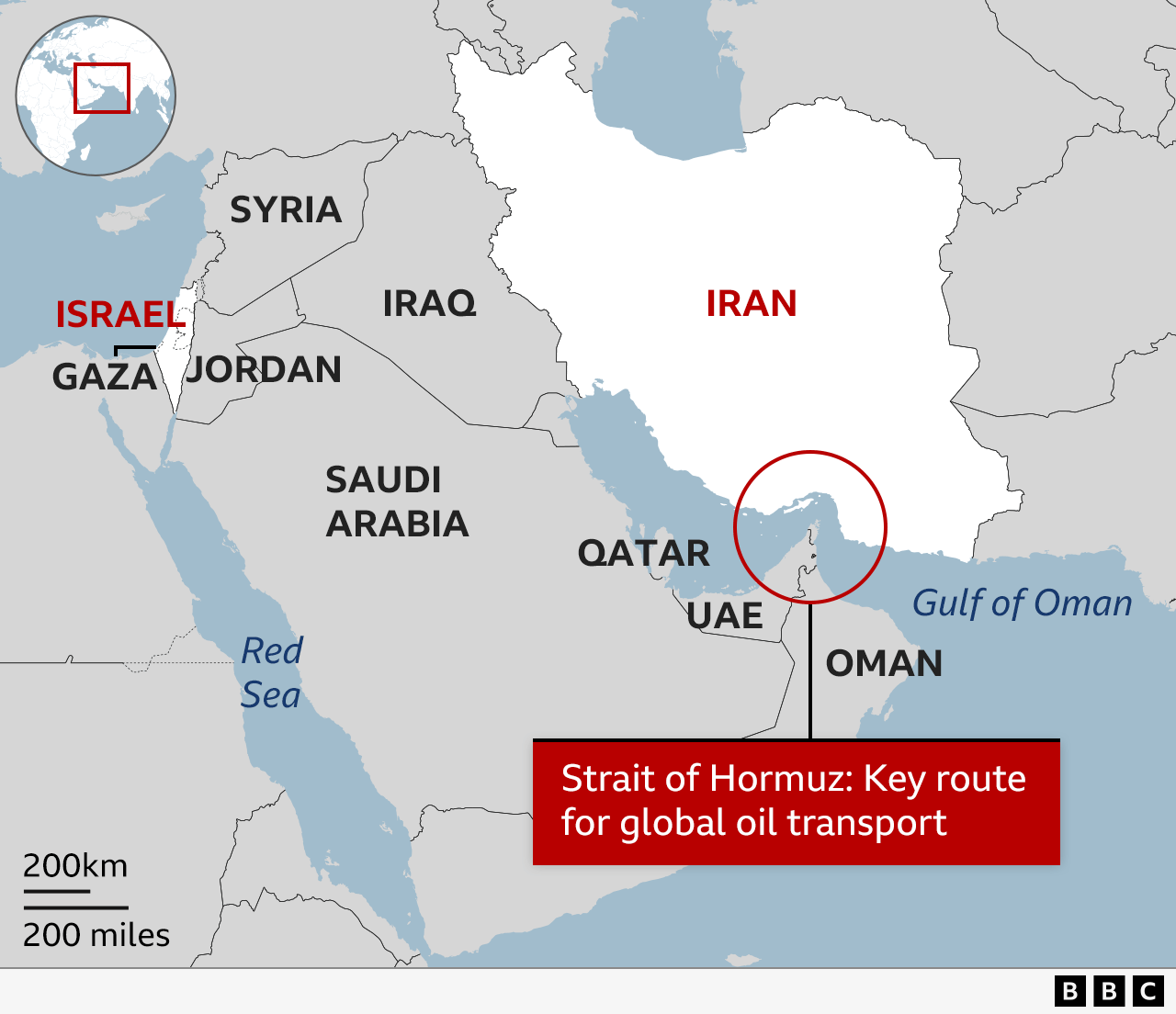

Oil’s next major drop followed escalating tension in the Middle East that led to the U.S. striking nuclear sites in Iran. Oil prices spiked as Iran threatened to close the Strait of Hormuz, a key artery for energy supply chains across the globe. Roughly 20% of the world’s liquified natural gas flows through the strait, which is also a critical route for oil and petroleum. For geographical context, we wanted to share this helpful map from the BBC.

A shutdown would cause significant supply chain disruptions and likely create an immediate supply shock within global energy markets. The U.S. has moved naval assets into the region to discourage this activity.

If Iran were to close the strait, energy prices would climb quickly. The U.S. economy is in a much stronger position than previous energy crises because it is a net exporter of oil. This would, however, complicate the Fed’s current stance on interest rates. The Fed is generally consistent in its discounting of more volatile inflation components, but spiking energy prices would put upward pressure on CPI.

Iran would also suffer major consequences. Energy sales have been a key source of revenue for the current regime and curtailing them would have an immediate, negative impact on their economy. Other countries in the region, Qatar for example, ship the majority of their exports through the strait. They would suffer similar economic consequences and effectively be pulled into the conflict.

Oil prices moved decisively lower after the ceasefire was announced on Monday night. De-escalation is critical in settling down global energy markets, and we’re monitoring developments closely as this latest geopolitical shake-up pans out.

Fedspeak from June

Last week, the Fed held interest rates steady while signaling that there is a chance it will resume interest rate cuts later this year. This was widely expected, and the meeting was devoid of any major surprises, though an updated Summary of Economic Projections (SEP) provided additional color.- In the latest SEP since March, inflation and unemployment expectations for this year both increased, primarily due to the continued tariff uncertainty.

- The new dot plot featured 12 officials forecasting at least one rate cut (10 actually favored 2 cuts) and 7 forecasting no changes in 2025.

Our view hasn’t shifted; we expect the Fed to be methodical and deliberate with its next move. An argument can certainly be made that it is time, based on the data, to resume interest rate cuts.

At the same time, volatile trade policy (paired with geopolitical uncertainty) seems to be enough to keep the Fed in wait-and-see mode. Powell said in his press conference, “We haven’t been through a situation like this, and I think we have to be humble about our ability to forecast it.”

Two notable Fed governors, Christopher Waller and Michelle Bowman, have chimed in during public appearances in recent days. Each indicated that they would support interest rate cuts in the near term based on current economic data.

Bowman’s comments in particular are notable because of her hawkish stance against inflation last year. She was the only dissenter when the Fed initially cut interest rates by 0.50% last September.

It is clear that the debate on the impact of tariffs is ongoing. Some in the Fed are gravitating towards the idea that they will indeed be inflationary but one-time price adjustments as markets adjust to the new tariffs. Others are likely more concerned that any increase in prices risks re-accelerating inflation.

We expect this debate to continue throughout the summer, especially as the deadline for the initial 90-day pause announced after Liberation Day creeps closer.

Powell also testified in front of Congress this week. The message, down the middle as usual, left pundits anticipating the Fed to punt any cuts in its July meeting and look towards September for the first possible cut.

“If it turns out that inflation pressures do remain contained, then we will get to a place where we cut rates sooner rather than later, but I wouldn’t want to point to a particular meeting,” said Powell.

It seems that the support is there for cuts today, but the trade policy uncertainty needs to resolve before the Fed believes inflation is contained enough to start cutting interest rates. This underscores why energy inflation is key. As mentioned previously, the Fed is likely to discount short-term volatility in energy prices, but a spike upwards does not bode well for the resumption of cuts sooner rather than later.