- Cash on the Sidelines

- The "Wealth Effect" and How it is Impacting Markets

Cash on the Sidelines

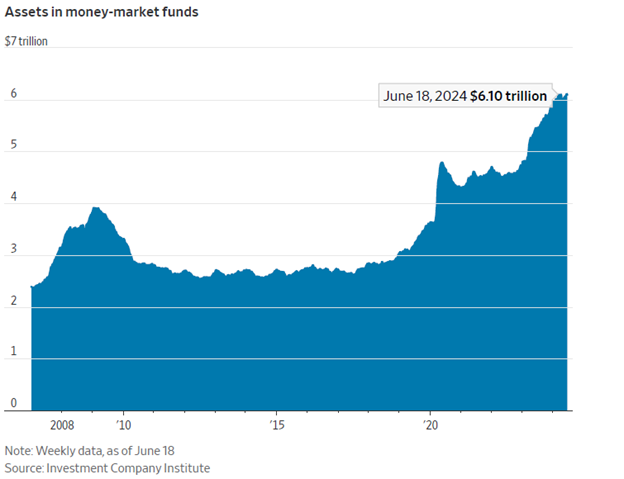

What happens when you get the largest fiscal stimulus on record paired with aggressive Federal Reserve interest rate hikes? Consumers across the board continue to run higher balances in their cash accounts.Money market mutual funds, a typical parking spot for savings or cash headed into investment portfolios, had assets of ~$6.1 trillion at the market close on June 18, per the Wall Street Journal chart below. This figure combines both retail and institutional investors.

For retail investors, it underscores the fact that many are still comfortable with trading off market risk for the current high yields on these money market accounts. Given that the yield curve is inverted (short-term debt is paying more interest than long-term debt), the burden of proof to invest cash is much higher. We all recall the era of ultra-low interest rates, where you needed to invest cash quickly because it wasn’t earning a meaningful yield.

For institutional investors, a significant amount of this extra cash has accumulated in the private markets due to a lack of investment amid recession fears in 2023. As interest rates continue to settle, and as the odds of a soft landing in the economy rise, institutional investors should become more comfortable deploying capital.

Many reference these high money market balances as a bullish sign for markets, noting that this cash can serve as a cushion during economic weakness or serve as future fuel for markets as investors become comfortable and look to invest it. This assessment makes sense, but also keep in mind that the new “higher for longer” interest rate regime will likely have an impact on investor psychology. We shouldn’t evaluate this change in a vacuum, considering that the ultra-low interest rate regime of the 2010s made holding cash punitive to returns.

Now that investors can get some interest from their cash, the bar to invest that cash has risen. Investors need to balance this with the current expectation that short-term interest rates will likely be cut at some point in the next 6-12 months. Higher cash rates today mean that investors are paid to be patient with their cash. However, they also need to be mindful of long-term goals so they don’t miss out on long-term returns just to pocket extra yield in the short term.

The "Wealth Effect" and How it is Impacting Markets

The wealth effect is an important psychological phenomenon that we experience in our day-to-day lives, often without even noticing it. The concept is simple: as asset values appreciate (investment portfolios, real estate values, etc.), consumers tend to increase their spending because they feel wealthier. This can serve as a powerful driver in the underlying economy and will likely work to bolster middle- and upper-class spending throughout this year.According to Torsten Slok, Chief Economist at Apollo, the market cap of the U.S. stock market has increased by $12.5 trillion since the Fed meeting last November, when the pivot to less restrictive monetary policy started. This major increase can positively impact the spending habits of the middle and upper classes, which can certainly underscore a thesis that economic activity should remain strong through the end of the year.

Who gets left behind? Lower-end earners typically do not have the excess funds to invest or purchase assets. They also tend to carry higher debt burdens as a percentage of their income. Unfortunately, in these environments, this cohort can be left behind. Slok refers to this as the “unstable equilibrium,” where the people who own assets are generally in good shape, but the people who owe money are feeling the pinch of higher interest rates.

In conclusion, the wealth effect is an asset to economic growth this year. It should continue to power the spending habits of middle- and upper-class earners (who contribute to ~80% of consumer spending), while the higher interest rate regime will continue to pinch the lower-end earners. It will be interesting to see how the Fed’s strategy plays out if this trend continues.