Tariff Exhale (For Now)

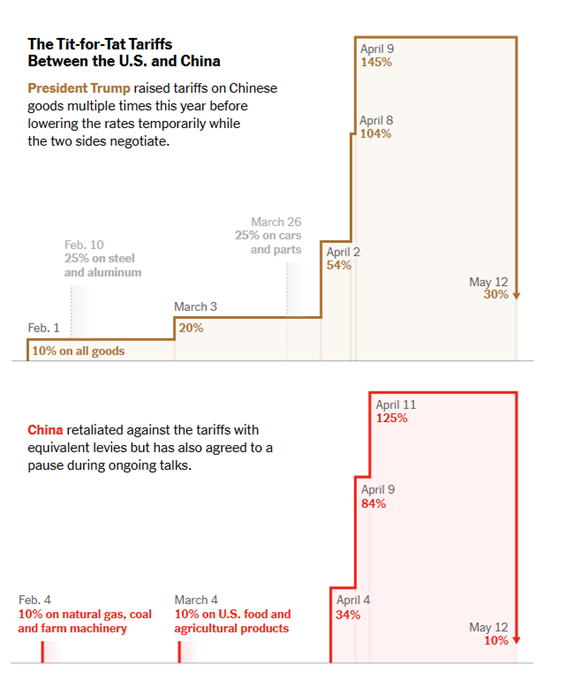

The about-face over the weekend contrasts with recent U.S.-China trade headlines from the last several weeks. From February 1 to April 9, the U.S. raised tariffs on Chinese imports from 10% across the board to 145%. In retaliation, China imposed tariffs of up to 125% on U.S. imports. The New York Times created a helpful visual timeline of events, which is below.

The 90-day pause lowers U.S. tariffs on Chinese goods to 30% and Chinese tariffs on U.S. goods to 10%, effectively the same levels as before “Liberation Day.”

As a further concession, China has suspended its restriction on the export of rare earth minerals, a move with significant supply chain and manufacturing implications for U.S. defense and technology companies. China is responsible for producing approximately 90% of a critical group of elements that are key components in the manufacturing of items like iPhones, Tesla vehicles and F-35 fighter jets.

We note that the agreement is only a 90-day reprieve, but the pause provides a window for further good-faith negotiations and potentially a more permanent resolution.

“The consensus from both delegations this weekend is neither side wants a decoupling,” said U.S. Treasury Secretary Scott Bessent.

Chinese Vice Premier He Lifeng described the talks as “candid” and “constructive,” while saying the countries have agreed to “new consultation mechanism,” according to reports from Chinese state-run media.

While we caution that a reprieve and friendlier rhetoric does not equate to an agreement, the change in tone marks a notable departure from the confrontational, tit-for-tat dynamics over recent months.

For now, we can exhale, but we remain mindful that summer could potentially bring renewed headline risk and volatility tied to trade developments. Markets may find cautious optimism in the pause today, but there is still significant work and progress before we feel comfortable declaring an “all clear.” Stay tuned.

Tariffs 101

Since President Trump’s inauguration, tariffs have taken center stage and flooded headlines. For a better understanding of why tariffs are at the top of Trump policy, Partner and Portfolio Manager Aaron Wall, CFA, breaks down the basics in just four minutes. Watch along below using the following timestamps.0:00 - Recap of the Tariff Landscape Before Liberation Day

0:34 - Trade Policy and How We Got Here

1:30 - Trade Deficits and Surpluses (with Examples)

2:48 - Market Expectations vs. Actual Outcome

3:37 - Takeaways: The Good and the Bad