In this week’s Investment Insights, we move away from the macro and take a closer look at how companies actually performed the first few months of the year.

Q1 Earnings: Mostly Positive

On Wednesday night, Nvidia released its highly anticipated first-quarter earnings report. Despite ongoing export controls that have limited sales to China, the results were widely considered a success.The company emphasized sustained demand for its Blackwell GPUs, which remain critical pieces of infrastructure for firms operating in the AI space. This continued strength underscores strong demand coming from the Technology sector as companies continue to build out data center and cloud computing capabilities.

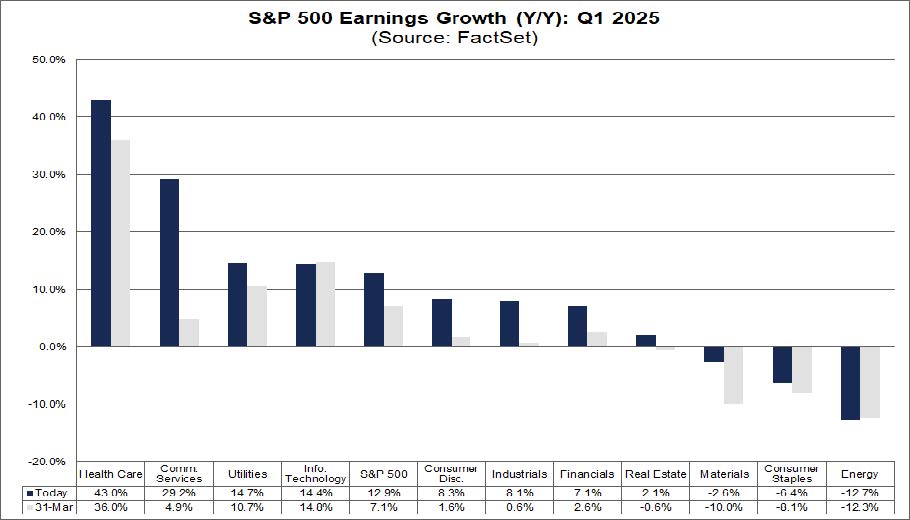

Nvidia’s report effectively served as the capstone to what has been a mostly positive earnings season. According to FactSet, over 96% of S&P 500 companies have now reported results. Among those, 78% delivered a positive earnings-per-share (EPS) surprise. The blended year-over-year EPS growth rate sits at an impressive 12.9%, marking the second consecutive quarter of double-digit earnings growth.

Eight of the eleven S&P 500 sectors posted positive earnings growth, with Health Care, Communications and Utilities leading the way.

Source: FactSet

However, while the headline results were broadly encouraging, forward-looking commentary from many companies revealed growing concerns, particularly about trade and the global operating environment. Firms like American Airlines, Volvo, UPS and Ford all either pulled or suspended their full-year guidance, citing a lack of clarity around evolving trade policies and global demand dynamics.

Analysts are currently forecasting second-quarter earnings growth of 5.1%, with full-year 2025 earnings projected to rise by 9.1%. While still positive, the estimates represent a step down from the strength seen in Q1, highlighting a potential moderation in momentum during the months ahead.

These results largely confirm what we've come to understand about the U.S. economy: it remains on relatively solid footing as we head into the summer. That said, the path forward is anything but guaranteed.

President Trump has announced he will hold off on additional tariffs against the European Union until July 9 and August 12 for China. While we remain optimistic that there is a mutually aligned benefit for deals to get done, we also acknowledge trade- and macro-related concerns could resurface very quickly.

Still, it's important to acknowledge how resilient companies have been in the face of macroeconomic headwinds, which potentially bodes well if more trade agreements are announced before the summer is over.