In addition to the cut, the Fed also announced plans to end its quantitative tightening (QT) program (or balance sheet reduction) on December 1, marking a significant step after nearly two years of balance sheet run-off.

The end of QT easing will likely hold the Fed’s balance sheet steady at around $6.6 trillion, as the Fed will start to reinvest proceeds of maturing bonds back into Treasury bills. For context, the Fed’s balance sheet peaked post-Covid at roughly $9 trillion, with the goal of keeping ample liquidity within the U.S. financial system.

Where Does the Fed Go From Here?

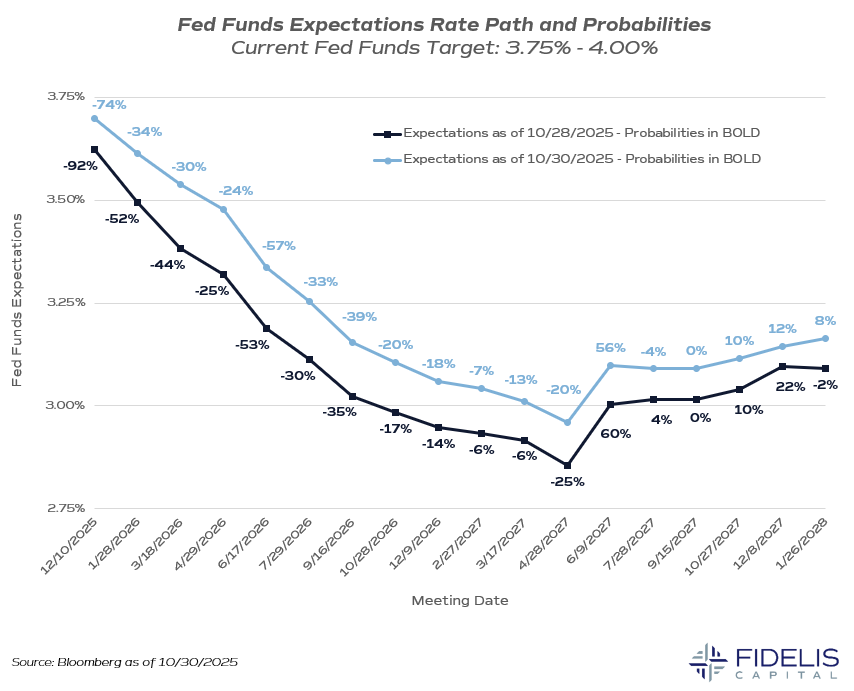

Although the 25 basis point cut was all but priced in, there is a lack of clarity around what the Fed’s next move will be. In his post-meeting press conference, Fed Chair Jerome Powell described the Fed as “driving in the fog,” a reference to the difficulty of making policy decisions with limited data amid the ongoing government shutdown.He also said an additional rate cut in December is “not a forgone conclusion.” Prior to this week’s meeting, the market had priced in a 92% probability of a December cut. Post-meeting, that number stands at 74% as of time of writing.

Additionally, factoring in a hypothetical December cut, the market now expects the next cut to be in April 2026. See the chart below for the market’s recalibrated expectations for future fed funds moves.

Further clouding Powell’s crystal ball is dissent among FOMC committee members. The committee’s vote was 10-2 in favor of a 25 basis point cut. As expected, recent Fed Board appointee Stephen Miran voted for a steeper 50 basis point cut (as he did during the September Fed meeting), while Kansas City Fed President Jeffrey Schmid voted for no cut all at. The split dissent was the first for the FOMC since 2019.

Powell noted the “strongly differing views” and stated, “There’s a growing chorus now of feeling like maybe this is where we should at least wait a cycle…”

How Should We Take This as Investors?

The path of lower rates still looks to be intact despite Chair Powell saying that the committee is having a hard time agreeing on the timing and cadence of future cuts. The Fed continues to grapple with its dual mandate of full employment and price stability, now impeded by limited data as a result of the government shutdown.Inflation appears to be moderating, albeit at a level higher than the Fed’s self-imposed target of 2%, while the labor market continues to wobble. Companies seem reluctant to hire due to continued policy uncertainty combined with focus on AI-driven efficiency (see this week’s announcements from Amazon and UPS).

The Fed’s next meeting is scheduled for December 9-10, and a lot could happen between now and then on the economic, policy and fundamental fronts. There is little doubt the Fed is struggling to reconcile the conflicting trends of its dual mandate, while the continued lack of visibility into the underlying economy only further complicates its job. The weeks leading up to December 9-10 should be interesting—stay tuned.