The Fed's Battle is Only Beginning

The most recent employment and inflation reports from August are making the Fed’s job more challenging.Last week’s August job report was somewhat muddled. While it indicated the U.S. economy was still creating jobs at a historically healthy rate, it wasn’t as fast as most economists forecasted, implying continued cooling in the labor market.

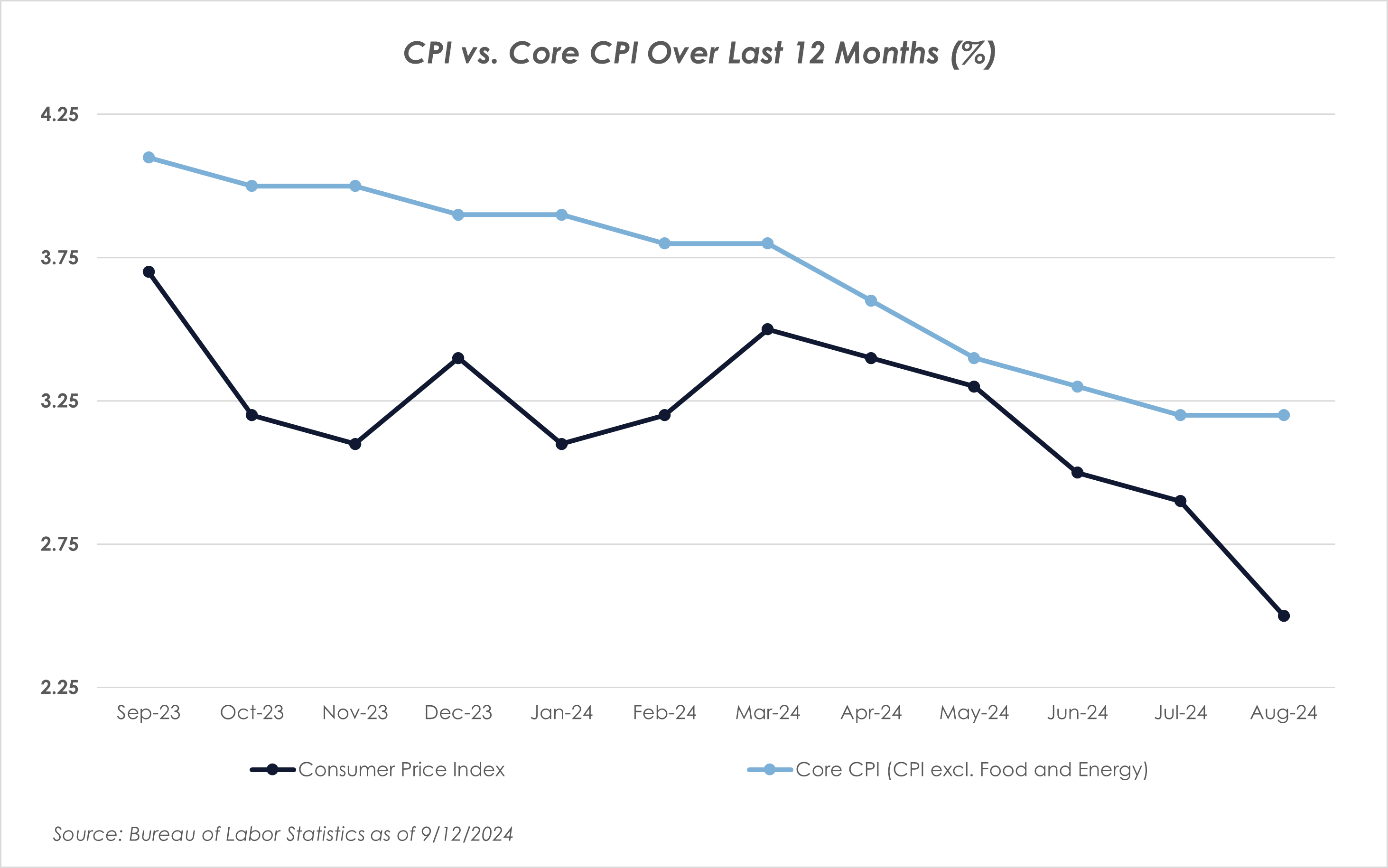

This week’s reports of August inflationary data were more nuanced. Headline CPI was up 0.2% for the month of August and 2.5% year-over-year, in line with most economists’ expectations. The 2.5% YOY growth from headline CPI is the lowest level since February 2021. That’s a good sign for the Fed in its fight against inflation. But, core CPI (CPI excluding food and energy prices) rose to 3.2%, up 0.3% for the month and higher than the forecasted 0.2% increase.

The biggest cause for the rise in core CPI was shelter costs, which were up about 0.5% – representing about 70% of the increase. The shelter index is up 5.2% YOY and presents a major hurdle in the Fed’s battle to push inflation closer to its self-imposed 2.0% target – shelter costs comprise about a one-third weighting in the overall CPI index.

What Will Happen at the FOMC Meeting?

The market is having a hard time digesting these conflicting signals. Last week, there was a roughly 50% chance of a 50 basis point cut. This week, the odds dropped to 15% post-CPI report on Thursday, only to push back up to ~40% by markets open on Friday.The oscillating market expectations over the last week highlight the Fed’s challenges as it embarks on a rate-cutting cycle. The Fed has already signaled that it is prepared to cut rates in an effort to support a slowing labor market. But the question becomes at what pace can it cut, given that, while the pace of inflation is slowing, there are still meaningful pockets of the economy—namely housing—where prices remain stubbornly high.

Powell has consistently emphasized that future Fed decisions will be data-dependent, underscoring the importance of evaluating economic conditions in real time. The Fed's dual mandate—promoting full employment and ensuring price stability—requires balance, and that balance becomes even more challenging when the data from these two areas conflict.

On one hand, the labor market remains relatively strong, but recent signs of slowing job growth suggest the economy may be cooling. On the other hand, the most recent inflationary data, particularly the core CPI reading, signals that inflation still has pockets of concern.

Powell's ability to strike the right balance between supporting growth and controlling inflation means that the Federal Reserve is far from declaring victory. In our view, the battle is just beginning, and the Fed's actions in the coming months will be pivotal.