Today, we’re discussing the key takeaways from the meeting and reviewing how lower interest rates will impact mortgage rates and money market funds.

Sept. Fed Meeting: 0.25% Cut, One Dissent

The labor market was front and center at the Fed’s September meeting. As we’ve discussed over the last several weeks, it has appeared to soften since the last Fed meeting in July. The Federal Open Market Committee’s September statement referenced this by saying, “The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.”According to fed funds futures, the market remains optimistic that there will be continued rate cuts through the rest of 2025 and into 2026.

In addition to the rate cut, we were also watching the number of dissenting votes. Last meeting, two governors dissented to the decision to keep rates unchanged, favoring a 0.25% cut.

There were two ways to look at these dissents. The first, albeit pessimistic, view is that they were dissenting to curry favor with President Trump. The second view was that their arguments were on solid footing and that the labor market was in fact weaker than the data in July was suggesting.

With those two governors not dissenting this meeting, it appears that the second view holds more weight, which is a welcome sign for those of us rooting for Fed independence.

There was one dissent this meeting that came from the newest member of the committee (and recent nominee from the President) Stephen Miran. He dissented in favor of a 0.50% cut.

This was not unexpected and absolutely leans towards the first view mentioned above. It was a positive surprise to see Waller and Bowman on the same page with the rest of the committee, and Fed independence will remain a focus for us as we head into the remainder of the year.

What The Cut Means For Mortgage Rates & Money Market Funds

In his Forbes.com article this week, Partner and Head of Fixed Income Chris Gunster detailed how the Fed’s latest rate cut will impact interest rates and, by extension, mortgage rates and money market funds.We’re sharing an excerpt from the article below. Click here to jump straight to Chris’ full analysis.

The expected interest rate decline is both good and bad. The typical American household, with both short-term investments and a mortgage, will be impacted by this in two major ways: the interest rate on the amount of money they earn from investing and the amount of money they owe on loans such as mortgages.

What’s Bad?

Let’s start with what is bad in a lower rate environment, money market funds. The average yield on the largest money market funds is 4.08% as of Sept. 11, according to Bloomberg and Fidelis Capital.This yield is appealing when compared to inflation. According to the most recent Consumer Price Index (CPI) release, Core CPI (all goods excluding food and energy) was 3.1% year-over-year in August. This means the average real rate (nominal yield minus the inflation rate) is about 1%.

The current high rate on money market funds has been a boon for income-sensitive investors. The Investment Company Institute reports that the amount of assets invested in money market funds is currently over $7.3 trillion, a record, and it’s up over $455 billion this year alone.

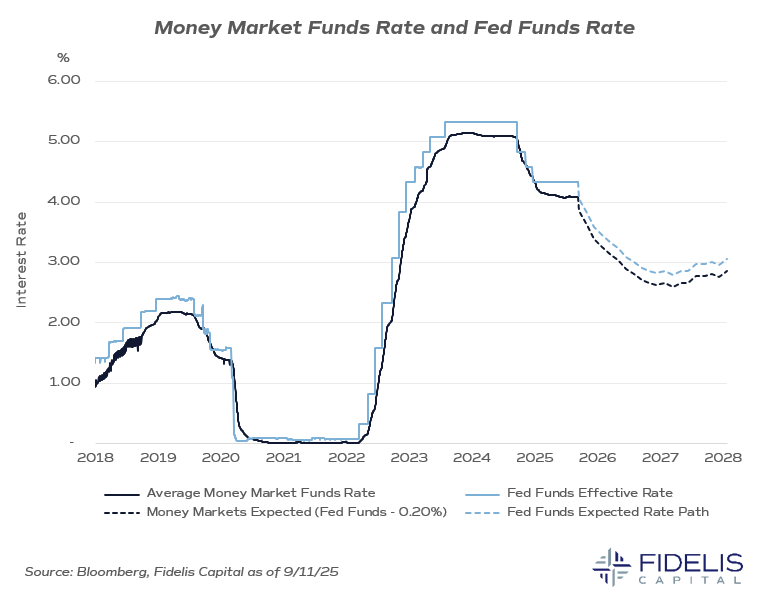

As the Fed starts to reduce interest rates, the yields on money market funds should also start to decline, more or less in lockstep.

If we combine the expected future path of the fed funds rate and the average spread to money market rates, then one would expect money market fund yields to decline in the near term and move below 3% in the second half of 2026.

What’s Good?

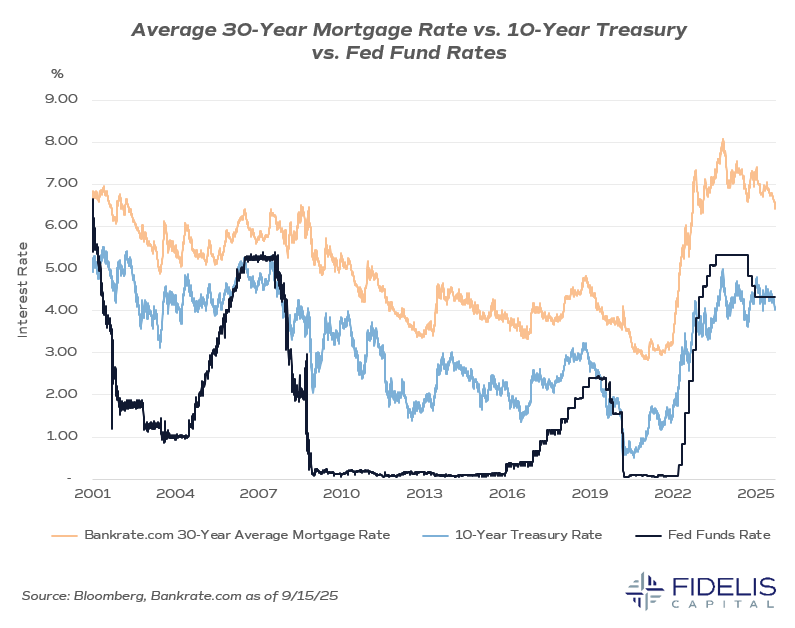

On the positive side, lower interest rates offer the opportunity to borrow money cheaper.We expect that mortgage rates will decline further in 2026, building on the initial decline this year. According to Bankrate.com, the average 30-year mortgage rate dipped below 6.5% as of Sept. 16, for the first time since February of 2023.

Mortgage refinancing activity has started to increase, according to the Mortgage Bankers Association. As I’ve previously discussed, mortgage rates are more correlated to the 10-year Treasury yield than the fed funds rate. In the past 20 years when the Fed has cut rates, mortgage rates have declined as well, particularly at the onset of Fed rate cuts.

If the trajectory of interest rates declines as expected, then we would anticipate a pickup in real estate activity because one of the key inputs in housing affordability is lower financing costs. (See my most recent piece about the housing market for further information.)

The opportunity to refinance an existing mortgage may present itself to an increasing number of homeowners in 2026 as the likely decline in Treasury yields could push mortgage rates through 6% and potentially lower.

Invite: Q4 Market Outlook Webinar

Mark your calendar for the upcoming release of our Q4 Market Outlook Webinar on Wednesday, October 15 at 4:30pm ET.Members of our Investment Committee will review the past quarter and latest Fed move, noteworthy market trends and themes to watch as we close out the year.