In our note this week, we talk about some of the factors that drove the Fed to make this decision, as well as some of the important areas to monitor as we embark on this easing cycle—including the Fed navigating a soft-landing playbook.

How We Got Here

At its October 2023 meeting, the Fed officially pivoted from a tightening policy to a pause (no rate hikes or cuts) under the belief that it had raised interest rates to a sufficiently high level for inflation to fall. The official statement included the following comments:"In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments."

There was a lot of noise in between this statement last October and the first cut this week, with the markets frequently over and underestimating the Fed’s next moves. However, the primary way to track conditions is to review the unemployment rate and CPI.

Remember that the Fed’s stated dual mandate is to minimize unemployment and keep inflation at its self-proclaimed target of 2%. This mandate is difficult to manage due to policy impacting both areas inversely.

Looking back at the data when the Fed paused, the unemployment rate was 3.8% and CPI was 3.2%. Fast forward to today and the most recent reading from August reported unemployment at 4.2% and CPI at 2.5%. From this simple data, we can see that higher interest rates helped the Fed towards its goal of a 2% CPI but also had the negative effect of increasing the unemployment rate.

When inflation was elevated in 2022, the Fed’s primary goal was lowering inflation. This is what led most of the economic world to forecast a recession because, typically, the Fed keeps interest rates too high for too long, causing an increase in the unemployment rate that invariably leads to a recession. This is the much-discussed “hard landing” scenario.

Although we are witnessing CPI tick down and unemployment tick up, the unemployment levels are not consistent with a recession. In fact, GDP estimates for Q3 2024 have recently moved higher, landing at 2.9% last week per the Atlanta Fed’s GDPNow tracker.

This positive economic data means the Fed may have the green-light to start shifting its primary focus back to both mandates instead of just inflation. Whether we’ve reached a true soft landing will have to be assessed in the rearview mirror next year, but the Fed’s decision to move forward with a 50bps cut signals that it believes this outcome is achievable.

The Fed’s Playbook

Now that we’ve discussed how we got here, let’s talk about what is important moving forward and look at the Fed’s Summary of Economic Projections (SEP). The SEP is released four times a year and comprises estimates of the path of various economic data points from the seven Fed governors and 12 Fed presidents.Before we dive in, it is important to keep in mind that these estimates are coming directly from the Fed. Since the Fed is the one guiding policy, its forward-looking estimates will always have an implicit bias that details a scenario where the policy is successful. That said, a few key points stick out from the latest release.

First, the median long-run estimates for inflation and GDP are 2.0% and 1.8%, respectively. Next year, the median estimates for those same variables are 2.1% and 2%. These estimates show that the Fed thinks its policy will guide us back to a more neutral economic environment, where growth is meaningful but not substantial, and inflation will continue to move towards the Fed’s long-term target.

For unemployment, the median long-run estimate is 4.2% and next year’s estimate is 4.4%. The Fed is expecting unemployment to tick up in the short term due to the lagged effect of higher interest rates. However, it does believe that it will avoid a recession and that the unemployment rate should start to move lower once the interest rate cuts start to work their way into the economy.

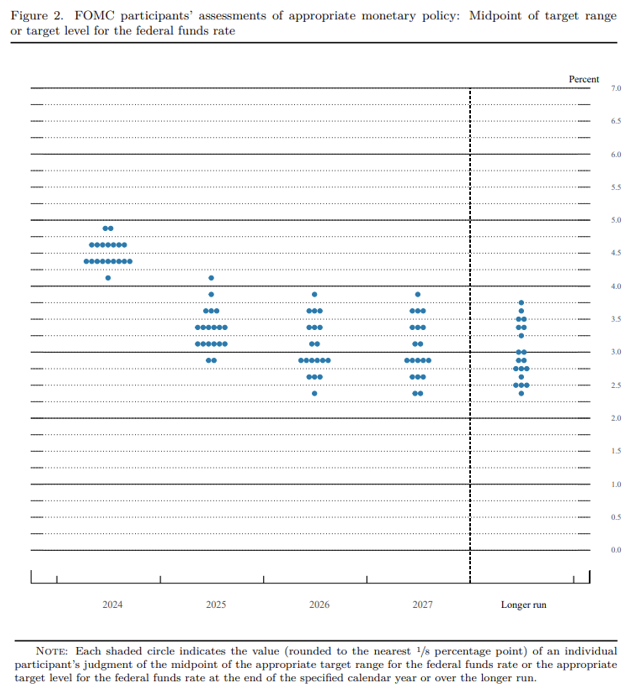

Another important point is the dot plot, a graphical representation of the estimated forward path for interest rates. The majority of respondents felt that markets would end 2024 at a base rate of either 4.50% to 4.75%, or 4.25% to 4.50%. With the remaining 2024 FOMC meetings set for November and December, this would indicate at least one more interest rate cut of 0.25% with the potential for a second.

This is extremely important because it signals that the Fed is not looking to cut in 0.50% increments moving forward. The estimates for year-end 2025 are more muddled, but the midpoint of respondents felt that it would be closer to 3.50%, indicating the potential for four more cuts in 2025. The dot plot is not written in ink and will likely undergo shifts as more economic data is available, but the preference is clear: the Fed sees more rate cuts in the next 12 months and we should not expect more 0.50% cuts based on the data available today.

Equally important information from this chart are the estimates for the longer run. This can be interpreted as each Fed member’s estimation of the neutral rate. The neutral rate is the interest rate where monetary policy is considered neither contractionary nor expansionary, signaling the economy is at full employment and stable inflation. The disagreement around the target neutral rate is wider here, with an official range of 2.4%-3.8%, but it gives us an indication of where the target zone will be. Given such a broad range, the Fed is communicating that there is still a lot of work to do.

In his press conference after the release, Chair Powell was asked about where the neutral rate may be and if we should expect the Fed to be working back to a near 0% interest rate like we saw for much of the last 15 years. His response indicated that the Fed does believe the neutral rate is higher than it had previously been:

"Intuitively most, many, many people anyway, would say we're probably not going back to that era where there were trillions of dollars of sovereign bonds trading at negative rates, long-term bonds trading at negative rates. And it looked like the neutral rate was, might even be negative, so and it was, people were issuing debt at negative rates. It seems that's so far away now, my own sense is that we're not going back to that. But honestly, we're going to find out. But it feels, it feels to me, and that the neutral rate is probably significantly higher than it was back then. How high is it? I don't, I just don't think we know."

Another important statement from Powell was that the Fed is paying attention to the revisions in labor data, specifically that the Fed needs to be careful evaluating the unemployment data live due to the significant revisions (mainly downwards) that we’ve seen over the last 12 months.

Why Start with 0.50%?

The argument for 25bps centered around moving slowly and within the typical bounds of Fed policy. The Fed likes to cut in smaller 25bps increments. The argument for 50bps centered around the idea that if the Fed believes cuts are necessary and that higher rates for longer run the risk of cooling the economy too fast, it might as well start off with a bang.Communication is also key. If the Fed ultimately believes that rates should be 1% lower by the end of this year, it is easier to start with 50bps and lay out a plan for smaller increments moving forward than it is to leave the door open for a 50bps cut at some point in the future. Hindsight is 20/20, though this also indicates the Fed probably should have cut rates by 25bps in July. Unemployment has ticked upwards since then and the downward revisions to job creation show that the economy may have been weaker than expected in the first half of this year.

Heading into the quiet period where the Fed is no longer allowed to speak publicly, Nick Timiraos of the Wall Street Journal wrote an article titled, “The Fed’s Rate-Cut Dilemma: Start Big or Small?” We highly recommend that anyone looking for clues on future policy pay attention to Nick’s articles. Heading into this story, the market was trending towards an expectation of a 25bps cut. Afterwards, the market started pricing in 50bps, which was ultimately correct. Either way, it did a good job of alluding to the fact the Fed was entering this meeting without a decision in mind, allowing the market to price in the potential for either outcome.

Powell has been burned by the market for poor communication in the past, and it is clear he is learning from previous mistakes.