Partner, Head of Fixed Income

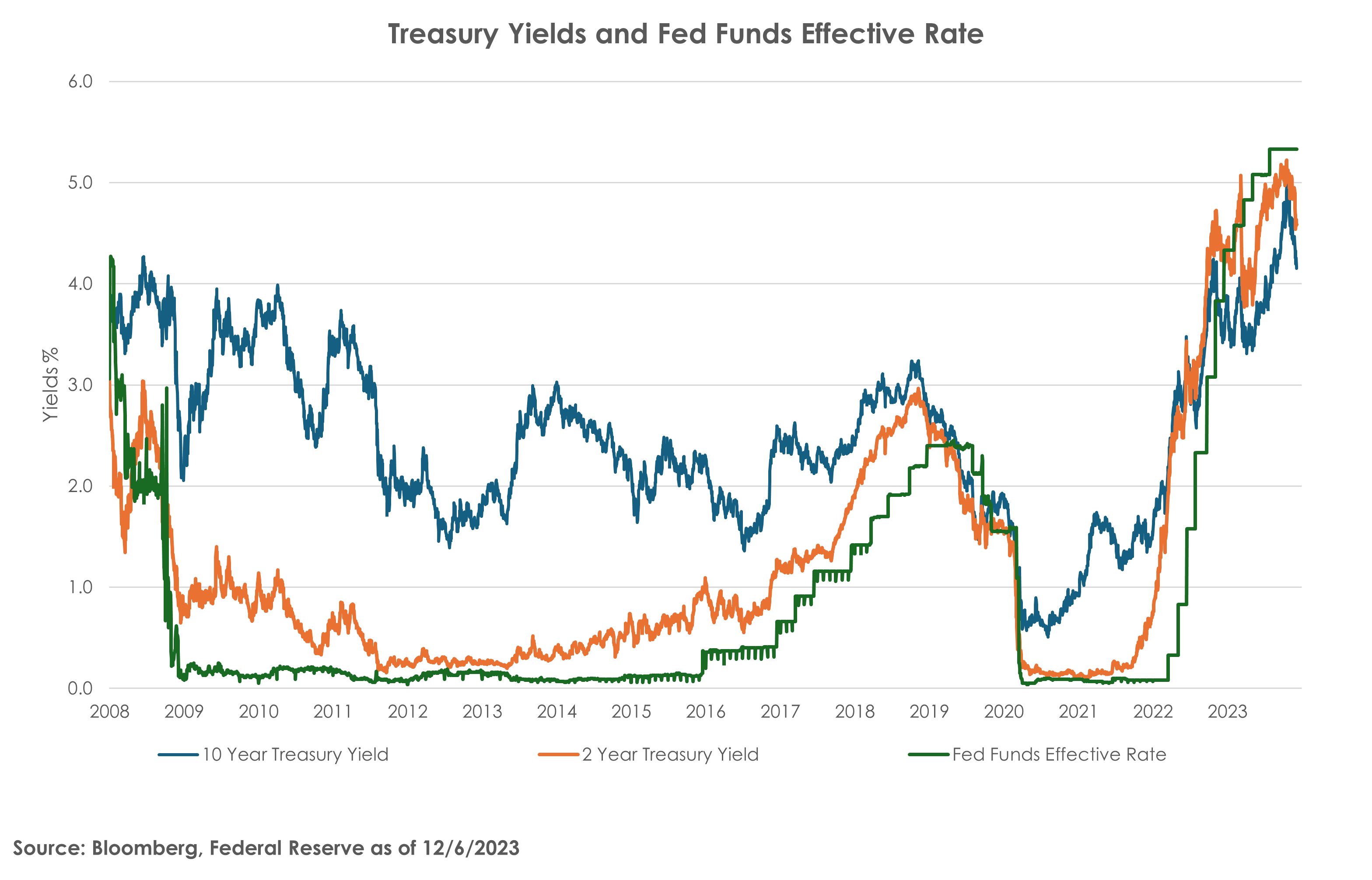

The recent rally in bond prices has been impressive but may have been too much and too fast. The 10-year U.S. Treasury yield has declined by over 0.85% and the 2-year U.S. Treasury yield by over 0.62% from their peak yields in mid-October. This latest move puts most of the investment grade bond market indexes into the black for the year, with some exceptions for very long-dated Treasuries. The driver of this extraordinary move has been the more favorable employment and inflation data pushing market expectations for a cut in rates solidly into March of 2024.

At Fidelis Capital, we were strong advocates of adding duration to fixed income portfolios when the 10-year U.S. Treasury yield breached 4.5% and again when it approached 5.0%, which we discussed during our Q4 Market Outlook webinar. Our recommendation was based on historically high nominal and real yields in domestic investment grade markets, levels not seen since the Great Financial Crisis. However, we do believe that the recent move has been overdone and may be setting up for a reversal.

Bond markets are pricing in an inflation-friendly payroll and unemployment rate for the December 8 release. The Bloomberg survey of market participants is expecting an increase in nonfarm payrolls of 187,000. The so-called whisper number, an unofficial and informal survey, is much lower at 159,000, as of the morning of December 6.

We would suggest that if the change in nonfarm payrolls is at or above this number, then we could see a reversal in the latest move lower in yields and a change in the market’s view of a cut for March to that of May or beyond. The velocity of the recent move lower has shown that the Treasury market is capable of very large moves in a very short time. We are keeping a close eye on this volatility and what a large miss for the jobs numbers would mean to risk markets.

To be clear, as the graph shows, we still believe that, strategically, the bond market is appealing. Even after the most recent rally, yields are still historically attractive on a nominal and real basis. To the extent that investors are underweight in fixed income assets, we continue to recommend a marginal reduction in such an underweight. That being said, we believe that if the December 8 numbers come in as expected or slightly lower, then Treasury yields are unlikely to move lower as markets have already priced that in that expectation. However, a miss to the upside (more jobs than expected) could see a strong reversal of the recent rally and a selloff in risk assets.

All investments involve risk and unless otherwise stated, are not guaranteed. Investment strategies discussed are general in nature and do not represent personalized investment advice. Be sure to consult with a tax professional before implementing any investment strategy. Investment Advisory Services offered through Fidelis Capital Partners, LLC., an Investment Advisor registered with the U.S. Securities & Exchange Commission. Registration does not imply a certain level of skill or training. Please refer to our ADV brochure found at https://adviserinfo.sec.gov/ for a complete description of services offered through Fidelis and for a complete description of fees.