By: Aaron Wall, CFA

Partner, Portfolio Manager

On the equity front, we are already starting Q4 earnings season. Institutional banks, as per the norm, kicked things off this week with solid releases. Goldman Sachs, Morgan Stanley, JP Morgan Chase, Bank of America, Citigroup and Wells Fargo combined to increase revenues by 6% for the full year of 2025, better than any previous year on record.

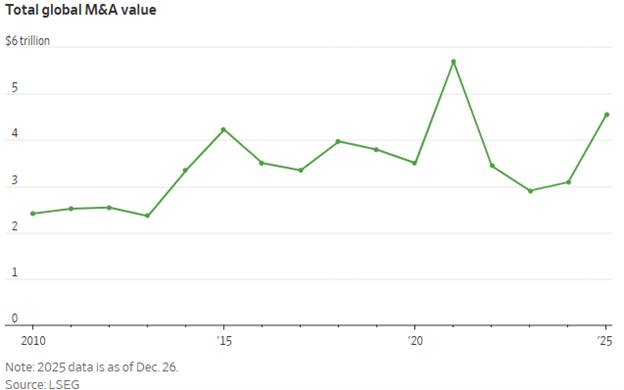

A big driver of this increase, and an important signal to the broader market, has been an increase in dealmaking from their investment banking and trading divisions. Global mergers and acquisitions volume finished the year strong after sluggish levels in the three years following the pandemic boom, as seen in this chart from The Wall Street Journal.

Looking at 2026, reports indicated that these firms expect dealmaking to continue and the IPO market to start heating up. There is ongoing speculation that some of the largest privately held companies are considering going public, something that could provide a nice injection of fresh, new stocks for the index…and blowout fees for the investment banks.

As the sectors reporting earnings begin to broaden out over the next few weeks, we’ll be watching forecasts for 2026, commentary on existing geopolitical risk, and expectations for capital investments.

FactSet's overall forecast heading into earnings season is for an 8.3% YOY growth rate, which would mark the 10th consecutive quarter of YOY earnings growth from the index. Outsized earnings can serve as strong fuel for bull markets, especially if they can continue to broaden outside of just the Technology sector—stay tuned.