By: Aaron Wall, CFA

Partner, Portfolio Manager

Happy New Year! We hope everyone had a nice close to 2025. We’re looking forward to what is sure to be another interesting year within markets.

For our outlook, please take a look at the December Monthly Market Recap (more about that below). We will also be sharing our Q1 Market Outlook Webinar on January 28 at 4:30pm ET, which will include a review of 2025 and our thoughts heading into 2026.

Venezuela & Crude Oil

The operation in Venezuela this past weekend started 2026 off on a controversial note.From a market perspective, a key indicator we have been watching is oil prices. Oil has, traditionally, served as a key geopolitical hedge due to its key role as an input to the global economy. When geopolitical tensions heighten, especially between energy-rich nations, oil has historically increased in value.

If we look back at the past year, we can see that oil prices peaked last January at nearly $80 a barrel and finished the year trading just above $60 a barrel.

Looking more critically at the year, oil prices fell dramatically after the Liberation Day tariffs announcement due to fears of a global economic slowdown. Oil prices then staged a swift rally in the summer on concerns about the US military operations conducted in Iran. These concerns were short lived, however, as the conflict de-escalated.

Oil traded lower to finish the year and has not shown much sensitivity to the Venezuela operation. In 2025, the relationship as a hedge seemed to break.

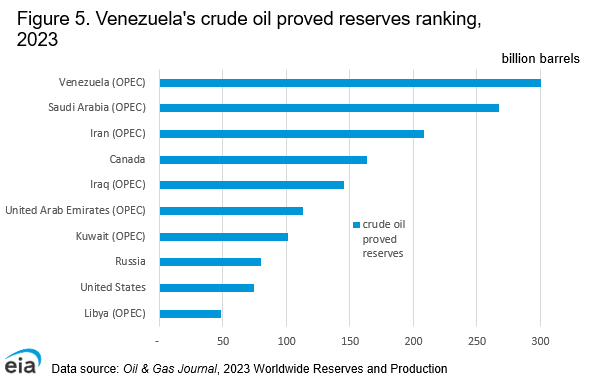

As seen in this chart from the US Energy Information Administration, Venezuela has the largest crude oil reserves in the world. Instability within the country should constrict global supply and cause oil prices to rise, but this has not been the case so far.

This is mainly because the US has significant sanctions on Venezuela, but another important factor (which also played a role in falling prices last year) has been the prioritization of domestic energy production in the US. Higher oil prices are felt substantially by consumers, so lower energy prices should prove to be a benefit in the fight against inflation.

This story is just beginning, but we’ll be paying close attention to how this operation will shape energy policy, geopolitics and macroeconomic conditions moving forward.

December Monthly Market Recap

2025 proved to be a year of resilience for both the economy and financial markets. Equity markets pushed through early tariff and inflation concerns for a third consecutive year of positive returns, with the S&P 500, Nasdaq and Dow all up nearly 15% or better on the year.Strength was not limited to equities. Fixed income delivered strong returns as underlying Treasury rates and spread levels moved lower. Precious metals recorded an impressive rally, with gold gaining 64% and silver surging 147%.

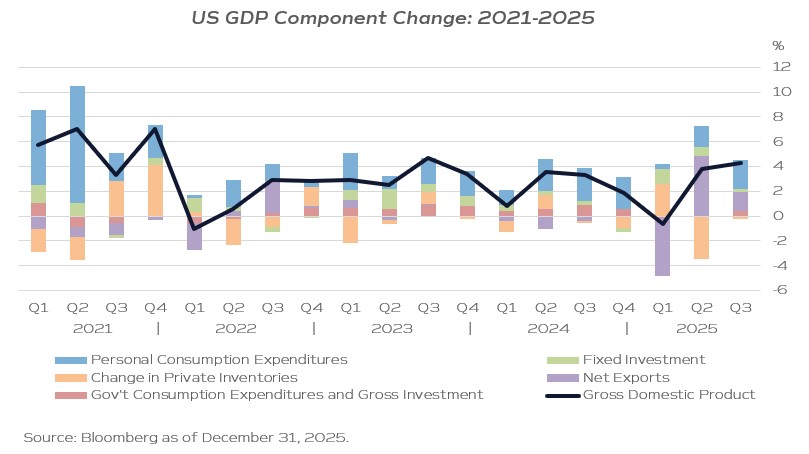

Markets persevered through Liberation Day and recovered growth while moderating inflation by year-end. Third-quarter GDP estimates hovered around 4%, while the Atlanta Fed is tracking Q4 GDP at roughly 2.5%. Though clouded by the federal government shutdown in October and November, headline inflation showed progress, slowing to 2.7% in November.

The Fed enters 2026 at yet another crossroad, this time hoping the December economic numbers will lift the “limited data” fog from last meeting. Headline inflation has moderated though is still above the Fed’s 2% target, and the unemployment rate has risen to 4.6% in November—the highest level in four years. Rate cuts totaled 0.75% in 2025, with markets expecting additional easing in 2026.

Review the December Monthly Market Recap, linked here, for deeper analysis from the Investment Committee.

Q1 Market Outlook Webinar

Looking ahead, 2026 presents a full slate of potential catalysts for investors. Key developments include a midterm election cycle, the appointment of a new Fed Chair, the World Cup, ongoing debate over the durability and profitability of the AI-driven investment theme, heightened geopolitical uncertainty, and the possibility of further monetary and fiscal stimulus.While outcomes remain uncertain, one thing is clear: 2026 is shaping up to be another eventful year for markets and the economy.

Mark your calendar for the upcoming release of our Q1 Market Outlook Webinar on Wednesday, January 28 at 4:30pm ET. Members of the Investment Committee will briefly recap 2025, identify what will drive markets in 2026 and review how we are positioning portfolios in the current environment.