By: Aaron Wall, CFA

Partner, Portfolio Manager

The Trump administration has not been shy in its monetary policy commentary, arguing that the Fed needs to start cutting rates soon to avoid being too late.

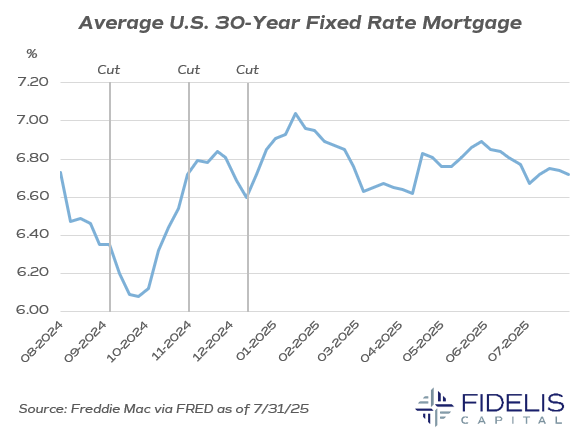

Some in the administration are also openly arguing that, with a slowing housing market, cutting rates can offer some relief. Although this argument is not inherently false, it’s worth looking at how mortgage rates have behaved since the most recent rate cutting cycle began last September.

This chart below shows the average 30-year mortgage rate over the last 12 months. When the Fed initially cut rates by 50bps in September 2024, mortgage rates did quickly decline. Since then, however, mortgage rates have returned to previous levels and remained stubbornly elevated—even though the Fed cut rates two additional times.

It’s important to remember that mortgage rates more closely follow the 10-year Treasury instead of the short-term interest rates set by the Fed. The 10-year has remained stubborn throughout the recent cycle due to volatile expectations around inflation, growth and economic stability that have dominated the last few months.

Will interest rate cuts be beneficial for mortgage rates? They can certainly help, but the story is a bit more complicated.