By: Aaron Wall, CFA

Partner, Portfolio Manager

In its final meeting of 2025, the Federal Reserve cut interest rates by 0.25%, a move widely anticipated by the market. However, the Fed remains at a crossroads.

Inflation is still above its 2% target, bolstering the argument of the hawks, who would prefer to keep rates elevated.

At the same time, unemployment is trending higher, and the labor market appears to be moving in a direction where interest rate cuts are more viable.

All of this is complicated by the fact that there has been limited data over the last two months because of the government shutdown.

“The FOMC is in a difficult position, compounded by internal division as evident by the three dissenting votes,” said Chris Gunster, our Head of Fixed Income. “As a result, the path forward is uncertain, and investors should prepare for a potential increase in volatility.”

Where Are Interest Rates Since The Fed Began Cutting One Year Ago?

At his press conference, Fed Chairman Jerome Powell said, “There is no risk-free path for policy as we navigate this tension between our employment and inflation goals. A reasonable base case is that the effects of tariffs on inflation will be relatively short-lived—effectively a one-time shift in the price level.”The Fed has kept interest rates higher this year as a precautionary measure because the impact of volatile tariff policy is unclear. With this week’s cut, the fed funds rate drifts to roughly 1% above the last inflation report.

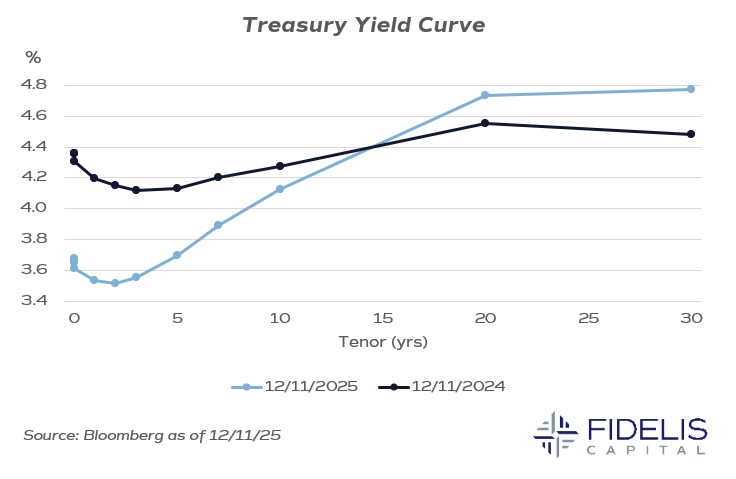

Interest rates have moved into more neutral territory from a more restrictive stance. The chart below shows the yield curve today (light blue line) compared to one year ago (navy line).

The step-down at the beginning of the light blue line highlights the impact of the recent interest rate cuts, but the step-up near the end of the light blue line shows that, although short-term rates are falling, the long end of the curve remains stubborn.

The 10-year Treasury is an important benchmark because it is more closely tied to the interest rate that consumers and businesses pay on their debt.

The fact that it remains effectively unchanged over the last 12 months means that the Fed’s monetary policy actions to cut interest rates have yet to truly filter into lower borrowing rates across the economy. Watching the yield curve will be key as we head into 2026.

What Is Next For The Fed?

The votes behind the decision this week sent mixed signals to the market. Importantly, there were three dissents in the 12 votes cast. One was a dissent in favor of a 0.50% interest rate cut, something we wouldn’t give much credence to. The other two dissents were in favor of not cutting rates.Looking at the rest of the votes, it appears some participants decided to vote in favor of the cut though would have preferred to hold rates steady.

The committee remains divided on whether inflation or the labor market should be the Fed’s top objective, but this debate clearly signals that the pressure to continue cutting interest rates in 2026 will persist.

Powell has three more meetings as Fed chair, and we expect that the Trump administration will soon settle on its nomination to replace him.

The Supreme Court will also hear arguments in January related to the administration’s attempt to fire Fed Governor Lisa Cook.

Together, all these points create a murky picture for the path of monetary policy next year, and it appears the Fed wants to hold its cards close to preserve a range of options as normal data flow resumes over the next few weeks.