Partner, Head of Fixed Income

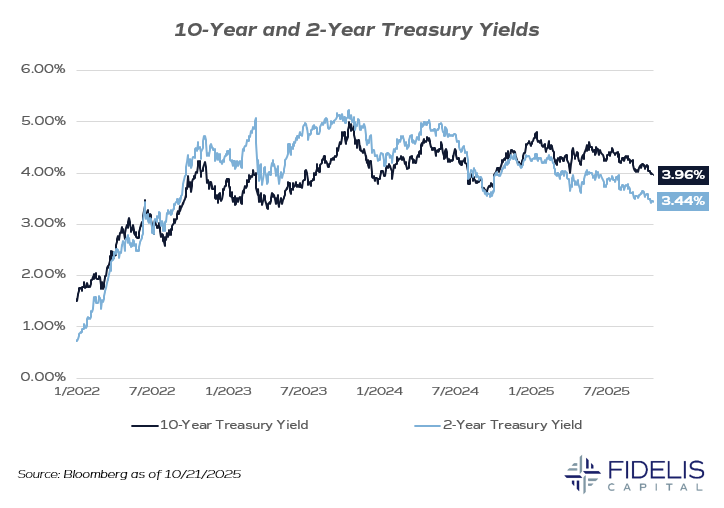

Concerns about a slowing economy and rising unemployment continue to weigh on interest rates. For the last four trading days, the yield on the 10-year Treasury closed at or below 4%, its lowest level in a year, while the yield on the 2-year Treasury closed below 3.5% over the last eight trading days to its lowest level in over three years.

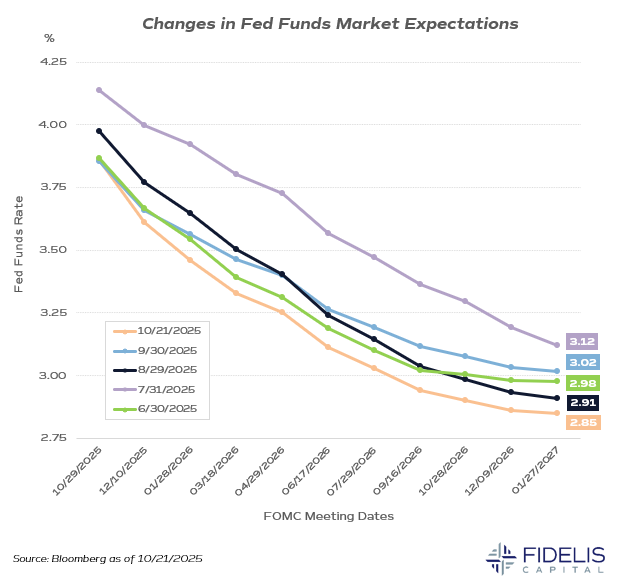

Along with the decline in Treasury rates, market expectations for additional fed rate cuts have been increasing, with terminal fed funds rate expectations shifting over the last four months. (The terminal rate is the lowest projected fed funds rate before the FOMC decides to halt or reverse course.)

Since the summer, terminal rate expectations have varied but remained around 3%. Coinciding with recent declines in the 2- and 10-year Treasury rates, market expectations as of October 21 show a meaningful move below 3% to 2.85%.

There has also been a change in the pace of rate cuts. The latest data shows a more aggressive path than in previous months, with the market now expecting the fed funds rate to fall below 3% by September 2026. That translates to six 25bp cuts over the next eight FOMC meetings.

While we agree that the fed funds futures market has a poor track record in accurately predicting the rates beyond eight or nine months, it is a valuable tool in assessing the market’s changing moods. For now, it tells us that the market expects the Fed to continue cutting rates to support job growth.

Additionally, the lack of government data in the last few weeks has not helped in confirming or rebutting the economic slowdown thesis. We are flying blind without this important economic data, most notably the inflation and employment data.

The most recent delayed report on CPI released this morning, October 24, showed a lower-than-expected inflationary environment. This should further cement the Fed’s more aggressive rate cut path and reinforce the message from the market that rates are moving lower.