Partner, Head of Fixed Income

Investment grade corporate bonds are an important sector of the bond market because they can offer potential additional return and yield above safe-haven U.S. Treasury bonds and expected inflation. This additional return varies over time and can be measured to get a sense of whether these bonds are cheap or expensive.

Money Manager’s POV: Corporate Bond Yield Spreads Are Historically Low

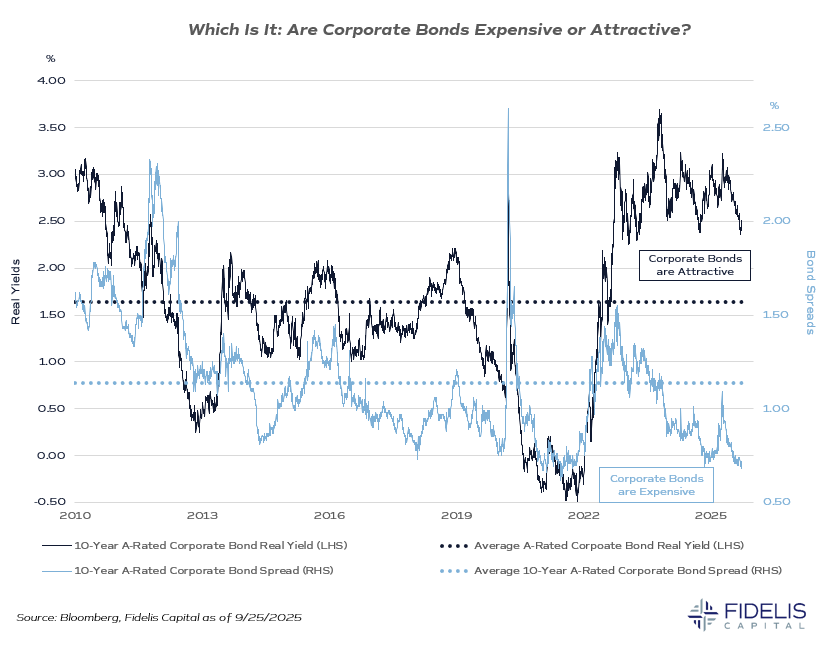

Yield spread is one measure of relative value in the bond market. It looks at the additional yield that corporate bonds or other types of fixed-income securities offer in comparison to similar maturity Treasury bonds. It measures how much investors are paid to take on the additional risk of a corporate bond.Current corporate bond yield spreads are low. As the chart below shows, for the average 10-year, A-rated corporate bonds, the additional yield (or spread) is 0.72% according to Bloomberg. This is near historic lows, which suggests that corporate bonds are rich (expensive).

Retail Investor’s POV: Corporate Bond Real Yields Are Largely Attractive

Another way to view the relative value of corporate bonds is to look at real yields, or the amount of yield a bond is expected to return above inflation. As an example, the expected real yield of a 10-year, A-rated bond is currently 2.51%. That is well above the average for the last 15 years. This measure tells us that corporate bonds are cheap.Which Should an Investor Believe, and What Should They Do About It?

We believe that corporate bonds offer relative value based on expected real yields. As a result, we are recommending an overweight in that sector, where appropriate, for each client.The above-average expected real yield should not be ignored. In the past, we have seen yield spreads remain at low levels for an extended period. We would prefer to earn additional income in the near term rather than wait for yield spreads to move higher.

We believe this is the correct interpretation of current market trading levels. While other fixed-income managers rely exclusively on yield spreads, we take a less myopic approach when it comes to relative valuation analysis.

We look at what is most beneficial to the client in both short-term and long-term horizons. Currently, the above-average level of income relative to expected inflation is our preference.