By: Michael Sellers

Partner, Portfolio Manager

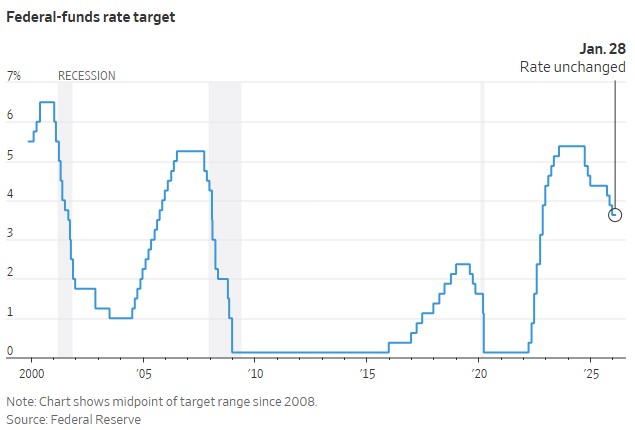

As expected, the Federal Reserve held its benchmark fed funds rate steady at a range of 3.50-3.75%. The Fed cut rates three consecutive times to close out 2025, making Wednesday’s decision the first time rates were left unchanged since last July.

How Long Will the Fed Pause?

The vote to keep rates unchanged was 10-2, with Governors Waller and Miran dissenting in favor of a 25 basis-point cut. In his press conference, Chairman Jay Powell emphasized that Wednesday’s decision had broad support. This was a notable contrast from last December’s meeting, which had three dissents—two opposing a cut and one favoring a larger cut of 50 basis points.Importantly, the FOMC’s prepared statement struck a more optimistic tone, with the opening sentence affirming that “economic activity has been expanding at a solid pace.” The statement continued, “Job gains have remained low, and the unemployment rate has shown signs of stabilization.”

Source: The Wall Street Journal

How should investors interpret this Fed pause? For one, the Fed is acknowledging that the US is coming into 2026 with an economy on relatively solid footing. As mentioned, Powell noted that the economy is expanding and the labor market picture is starting to stabilize. That’s a good thing.

Moreover, it’s evident that the Fed is comfortable taking a more patient, data-dependent approach before it makes another move. The fed funds rate futures market is pricing in two cuts for 2026 (in June and October), which would bring the terminal fed funds rate range to 3.00-3.25%.

Looking ahead, Powell’s tenure as FOMC chairman ends in May, and he has not indicated whether he will stay on the Board of Governors (his tenure as governor doesn’t end until January of 2028).

A new chair will soon have influence over future monetary policy direction. For now, though, the Fed appears comfortable with the current level of interest rates based on the direction of the economy and ongoing efforts to balance its dual mandate of full employment and price stability.