By: Michael Sellers

Partner, Portfolio Manager

Buy low and sell high.

It’s one of the first principles every investor learns. The phrase implies that investors should be patient, ready to take advantage of pullbacks before buying into the market.

But what happens if you blinked and missed the April low this year, or you sat on the sidelines throughout 2024 when the S&P 500 was up over 23% while notching 57 record highs?

With the Dow, S&P 500 and Nasdaq hovering near all-time highs last week into this week, should you continue to wait for the next correction—or is it time to hold your nose and start putting money to work?

Your gut probably suggests that you wait because that’s what we’ve been taught, but history will tell you something different.

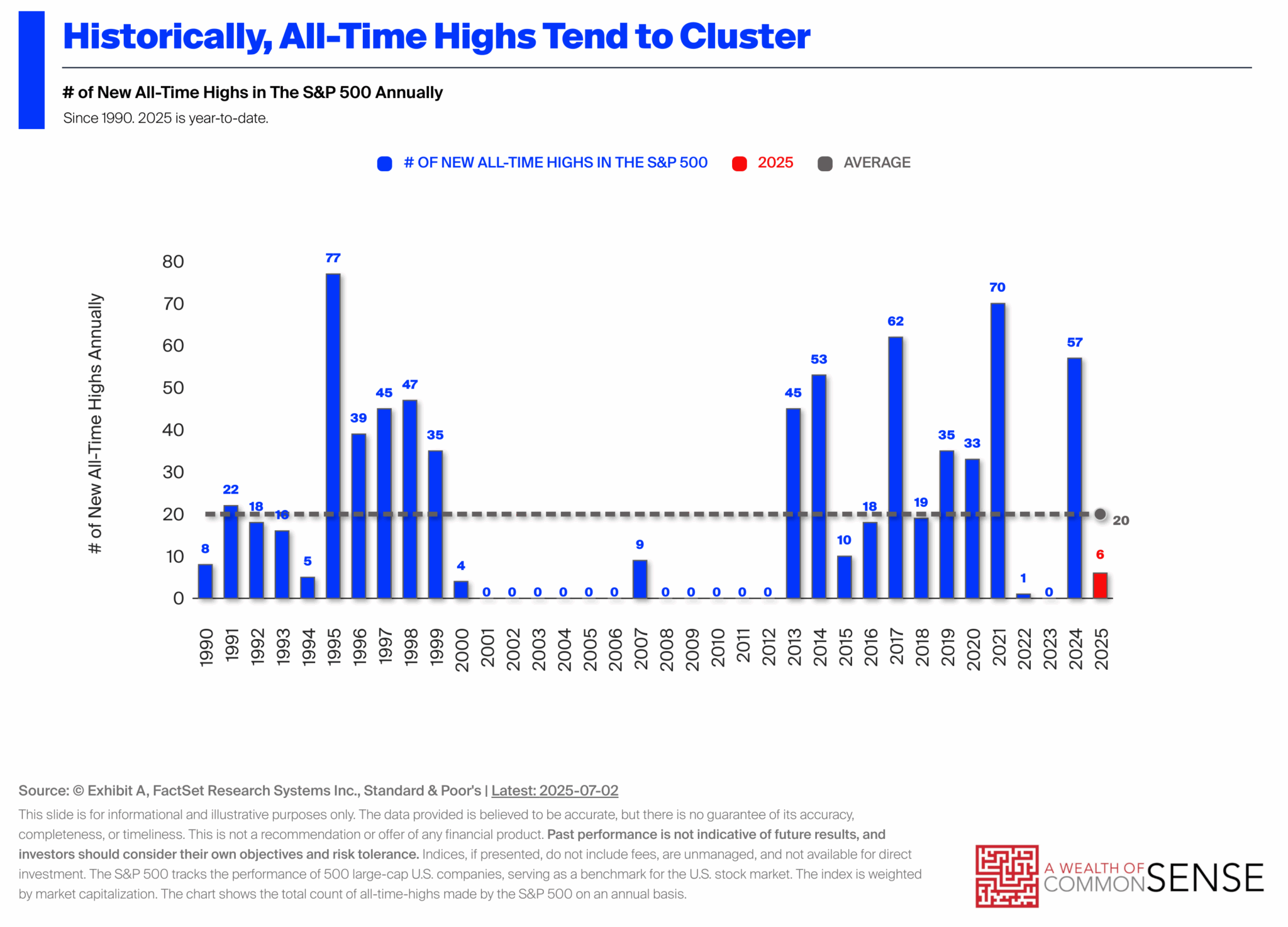

First, historical data tells us we shouldn’t be fearful of markets when they reach all-time highs because they occur quite frequently. According to data from Ritholtz Wealth Management, the S&P 500 has averaged 20 new highs every year since 1990.

Source: A Wealth of Common Sense

Those returns often cluster within bull market rallies, like the tech rally of the late 1990s and rebound post-Great Financial Crisis (GFC), although interestingly enough, it took until 2013 for the market to hit new highs post-GFC. There are also notable absences of all-time highs during two of the three most recent recessions, with Covid being the exception.

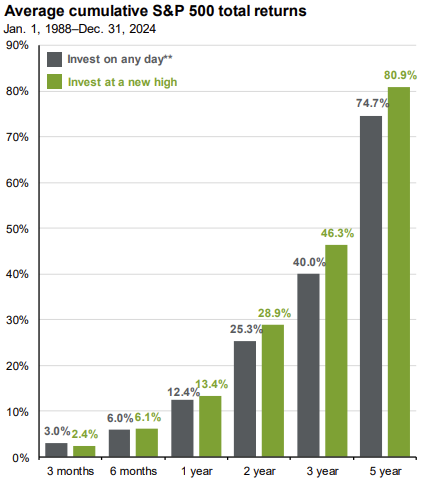

Data from J.P. Morgan suggests that investing at all-time highs often leads to higher forward returns compared to investing on any randomly chosen day. While this may seem counterintuitive at first, it becomes more understandable when we recognize that all-time highs tend to occur more frequently within bull market rallies.

Source: J.P. Morgan

This brings us to one of the most important principles in investing: time in the market matters more than attempting to time the market. Remaining patient and disciplined— through both the ups and the downs— is a far more effective strategy than trying to exactly time your entry and exit points.

Our perspective is this: investing is rarely easy, especially because perfectly timing the market is nearly impossible. It often requires just as much conviction to invest at all-time highs as it does during market pullbacks. But history has shown that investors should not fear markets that are at historical peaks, just in the same way we shouldn’t be fearful when the market sells off. Peaks and valleys, plateaus and troughs are all part of a normal market cycle.

More important than trying to outguess these market gyrations is staying focused on buying high-quality investments at valuations that are reasonable relative to their expected growth—and maintaining the discipline to hold them through the market’s inevitable ebbs and flows.

If you have any questions or concerns, please reach out to a member of your Fidelis Capital team.