On Monday, volatility surged to levels not seen since the pandemic. The intra-day high of 65.73 was surpassed by only two other readings since the VIX launched in 1992: the depths of the Great Financial Crisis in 2008 and the peak of the Covid crisis in April 2020.

What caused this most recent spike? First, equity markets were already showing signs of skittishness at the end of July due to uncertainties surrounding the U.S. presidential election, rising geopolitical risks in the Middle East and fatigue from the recent AI-concentrated rally.

Last week, additional fuel was added to the fire when the Bank of Japan raised its benchmark interest rate by 0.25%. At the same time, weaker-than-expected U.S. data points around unemployment and manufacturing reignited hard landing and recessionary fears.

With the Fed deciding to hold interest rates unchanged during last week’s meeting, expectations are that it will be forced to cut rates more aggressively in the future. The prospect of rising Japanese and potentially falling U.S. rates, coupled with a slower-than-expected U.S. economy, sent already softening markets into full-blown panic mode.

The resulting global sell-off began overnight Sunday, with the Nikkei experiencing its worst day since 1987, plummeting 12% due to a sharp reversal of the yen carry trade. This decline was followed by similar reactions in both the U.S. and Europe.

By the close on Monday, the Dow dropped over 1,000 points, while the S&P 500 and Nasdaq were both down over 3%. For the Dow and the S&P 500, Monday marked the biggest daily loss since September 2022. Conversely, bonds rallied, with the 10-year Treasury ending Monday at 3.78%—almost 1% lower than the 2024 high of 4.71% in April.

Monday night, the Investment Committee shared our thoughts about the volatility spike, which you can find linked below.

From the Investment Committee: What You Need to Know About Current Market Volatility

Fixed Income Stands to Gain from Markets Sell-Off

In summary, we felt Monday’s move in both stock and bond markets was overblown. We also discussed how volatility, though uncomfortable, is also part of a normal and healthy market cycle.

To reiterate our insights, here are a few interesting market facts to provide context around “normal” volatility.

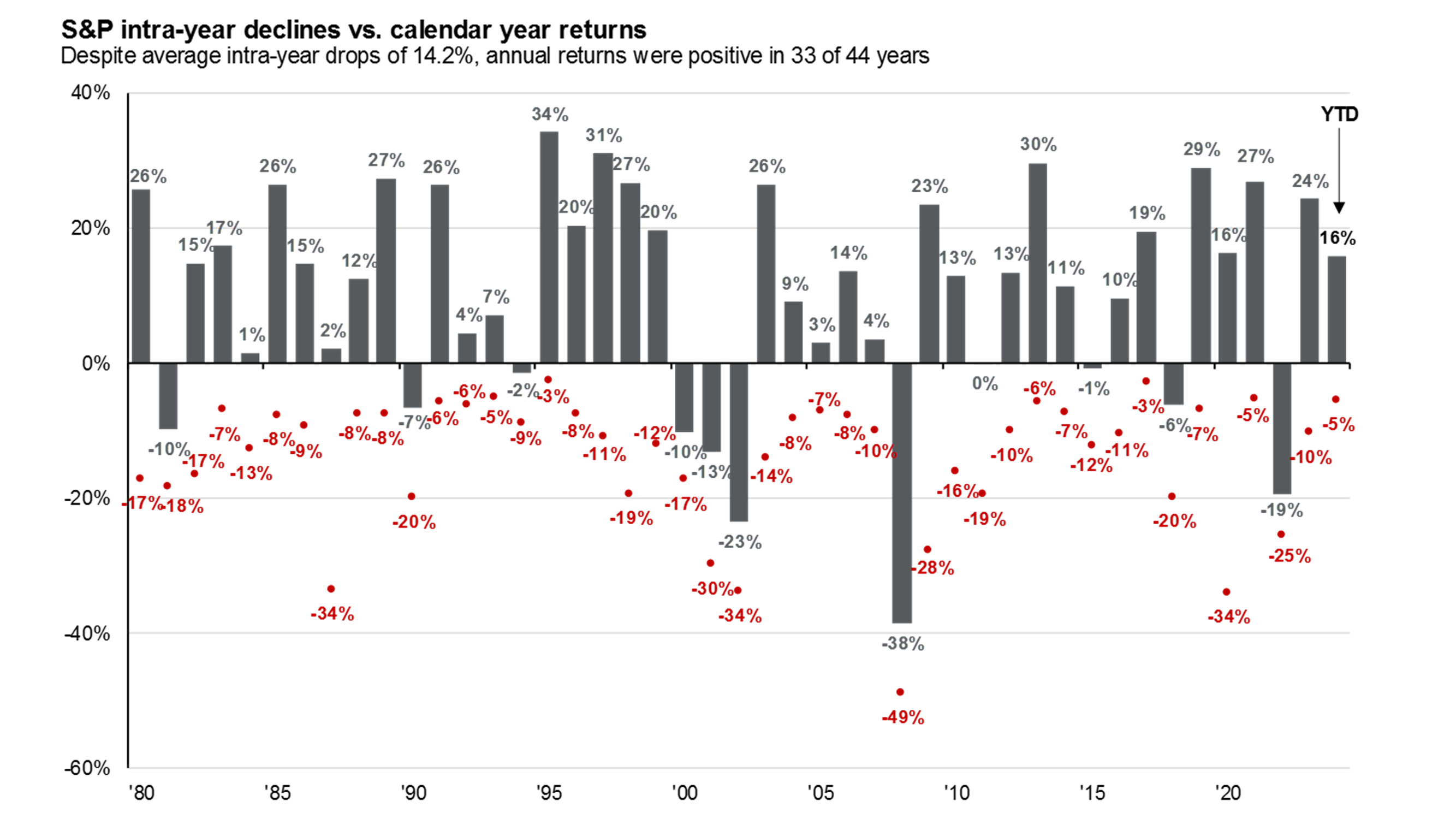

- Since 1950, the average correction in any given year is -13.7%. As of the market close on August 8, we are down roughly 6.5% from recent market highs.

- Since 1928, the market has been up 73% of the time, or 70 out 96 years. In 35 of the 70 positive years, there was a -10% intra-year correction in the market.

- 94% of the years since 1928 have had a drawdown of 5% or more, with 64% of the years experiencing drawdowns of 10% or more.

- The following chart from J.P. Morgan Asset Management illustrates annual market drawdowns in the context of the broader market since 1980.

Source: FactSet, Standard & Poor's, J.P Morgan Asset Management as of 7/31/2024

The takeaway is this: market drawdowns and corrections occur, and they occur frequently—even in longer-term market uptrends. These declines can feel uncomfortable, and at times scary, but they are also part of normal market activity. There’s value in knowing this; it prevents informed investors from taking irrational and emotionally driven actions at the detriment of their long-term goals and objectives.

Globally, stocks have appeared to stabilize as we progressed through the week, which is a positive sign. It is important to note that sharp volatility spikes, from a historical perspective, can lead to weeks and sometimes even months of choppy trading as markets become more sensitive to shorter-term momentum price trends. There may be more uneasiness ahead. We’ll have to wait and see, but we caution our clients from doing anything abrupt in times of heightened volatility.

We will leave you with one of our favorite quotes, from John Bogle, the founder of Vanguard: “The stock market is a giant distraction to the business of investing.” What this means to us is: make sure you can separate signals from noise, be confident in what you own in your portfolio and don’t get too distracted by short-term market fluctuations.