As we wrap up the last full week of September, it has been a strong month for global equities, with the S&P 500, Dow and Nasdaq all posting gains through the close on September 26. International, developed and emerging markets have also seen notable gains. The impressive performance in emerging markets has been fueled by a 10%+ jump in Chinese equities, driven by a massive stimulus package from the People’s Bank of China (China’s Federal Reserve).

In this week’s edition, we discuss the following topics:

- China Injects Economy with Stimulus Package

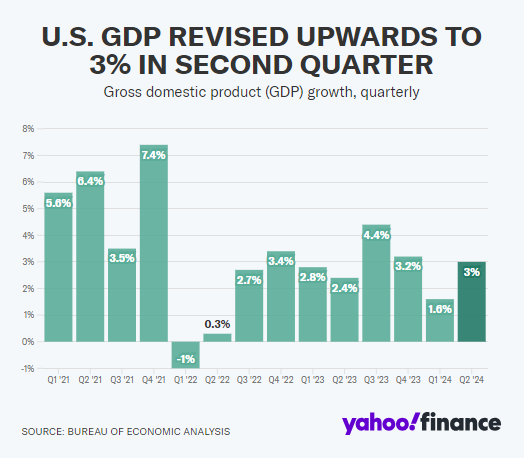

- Final Q2 GDP Figure Nearly Doubles Q1 GDP

- What Did We Learn in September?

China Injects Economy with Stimulus Package

China's markets have benefited from a massive stimulus package aimed at countering economic challenges such as weak consumption, declining private sector investment, and a housing market slump. The stimulus, estimated to be between $142 billion and $284 billion USD, includes lowering short-term lending rates, reducing reserve requirements for banks, easing mortgage rates while lowering deposit requirements for secondary purchases, and providing loans for corporate buybacks. The People’s Bank of China has also signaled that additional stimulus may be forthcoming, contributing to the broader "risk-on" sentiment in global markets.Final Q2 GDP Figure Nearly Doubles Q1 GDP

The U.S. Bureau of Economic Analysis (BEA) released its final revision of the second quarter GDP growth this week, reporting a 3.0% increase, slightly higher than the earlier estimate of 2.9%. This represents a significant improvement compared to the 1.6% growth in the first quarter of 2024.

The BEA's report highlights that this growth is mainly driven by consumer spending, private inventory investment and non-residential fixed investment. These sectors played a crucial role in sustaining the overall economic momentum. In particular, consumer spending remains a strong contributor, reflecting resilient demand despite potential economic headwinds like inflation or higher interest rates. The uptick in private inventory investment and non-residential fixed investment also suggests that businesses are maintaining a positive outlook, investing in long-term assets and infrastructure.

This acceleration in GDP growth is a positive signal for the broader U.S. economy. Third-quarter GDP is tracking 3.1%, according to the Atlanta Fed’s GDPNow tracker, potentially setting the stage for a stronger year-end set-up from a macro perspective.

What Did We Learn in September?

For one, the global rally in equities reflects that the animal spirit within investors is still strong. The U.S. economy also showed solid momentum, with second- and third-quarter GDP growth accelerating after a sluggish first quarter. The 3.0% growth in the second quarter, driven by consumer spending and business investment, indicates that the economy is still on stable ground.However, there are areas of weakening we are keeping an eye on. The Consumer Confidence Index for September posted its weakest month-over-month reading since August 2021, highlighting growing concerns about the labor market and business conditions. This decline in confidence suggests that consumers may be becoming more cautious, which could have a ripple effect on future spending. It's important to note that this data was collected before the Fed’s rate cuts in mid-September.

Labor market trends are another area of concern. While the economy has remained stable, any softening in employment or wage growth could further undermine consumer confidence. As we approach the fourth quarter, all eyes are on how consumers respond to the Fed's rate cuts and how external factors, such as the upcoming U.S. election and geopolitical tensions, could potentially influence market and economic conditions.