By: Aaron Wall, CFA

Partner, Portfolio Manager

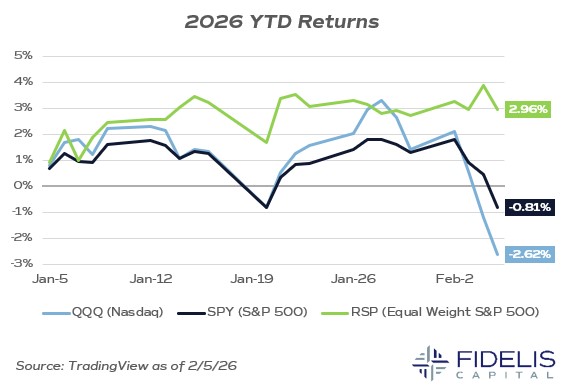

Markets had a choppy week to start February, but under the hood, we’re seeing a new story develop. As of yesterday’s close, the S&P 500 was sitting at a -0.81% YTD total return. The tech-heavy Nasdaq (as measured by the ETF QQQ) was at a -2.62% YTD total return.

A general downtrend in Technology has been brewing for a few months, headlined by weakness in software-as-a-service (SAAS) names. These companies are set to be disrupted by recently released artificial intelligence tools, including Anthropic’s Claude code.

Fears also mounted after the announcement that Kevin Warsh is set to be the Trump administration’s nominee for Chairman of the Federal Reserve. Let’s dive a little bit deeper into the recent market action.

Tech vs. Everything Else

One of the charts we frequently watch is the traditional S&P 500 versus the equal weight S&P 500. The traditional S&P 500 is market weighted, meaning that large companies represent a larger share in the index.Over the past few years, we’ve regularly discussed the performance of Magnificent Seven stocks (Apple, Microsoft, Amazon, Google, Meta, Nvidia and Tesla) and how they have been a key driver of the market.

Due to their impressive performance, these stocks have grown to a point where they have outsized influence on the traditional S&P 500. Currently, these stocks represent 33.6% of the entire index. As a comparison, there are 326 stocks that currently hold a weighting of 0.1% or less.

The equal weight S&P 500 adjusts for this, assigning all 500 stocks the same weight to give a better proxy for how the average stock is performing. That index (as measured by the ETF RSP) is sitting at a +2.96% total return for the year.

What does this mean? The market’s activity thus far has been rotational. We’ve explained previously that widening breadth would be a strong signal for markets. This just means that other areas of the market outside of Technology are beginning to participate in the overall rally.

Chris Verrone, Chief Strategist at Strategas, noted that on both Tuesday and Wednesday, more stocks finished the day higher than lower, even though the broader indices were weaker.

As mentioned in our monthly market recap, the best sectors of the market in January were Energy, Materials, Consumer Staples and Industrials. Even though the headlines look weak, it’s important to notice the strength that is building in the underlying market.

Bonus

The latest insights from the Investment Committee are now available. The January Monthly Market Recap, highlighted above, was released this week, and our Q1 Market Outlook Webinar, published last Wednesday, January 28.If you are looking for more commentary from the IC, we encourage you to review the recap and watch the webinar for our perspective on current and near-term markets.