1. Dockworkers Strike at Ports Nationwide

2. China’s Policy Support and Its Effect on Emerging Markets

Dock Workers Strike at Ports Nationwide

Beginning on Tuesday, half of our domestic ocean shipping grinded to a halt as dockworkers along the East and Gulf Coasts went on strike. The International Longshoremen’s Association (ILA), representing more than 45,000 port workers, was unable to reach a new labor contract agreement with the United States Maritime Alliance employer group by Monday’s midnight deadline.The ILA was seeking a 77% pay raise over the course of the new six-year contract and a ban on some forms of automation that would eliminate existing jobs.

On Thursday night, a tentative deal was reached, with workers agreeing to be back at work today. The details available point to a 62% wage increase over the life of the contract.

Resolving this negotiation quickly was important, though the strike was heavily telegraphed in the months leading up to Monday’s expiration, giving affected industries time to prepare.

Retailers, for example, have been pulling forward orders recently in an attempt to get ahead of the potential slowdown. This drove up freight prices in the interim, so some of the impact could already be baked in.

This inventory padding is not the sole reason for increased shipping costs, but we are trying to discern if this was a one-time increase due to the anticipation of the strike or the start of a meaningful trend of higher shipping prices moving forward. Earlier in the summer, we wrote about the increasing shipping costs and how they tend to lead increases in inflation. You can find that analysis linked here.

It is important to keep in mind that other unions have been paying close attention. Since the ILA has pulled off this large wage increase, we could see additional strikes for higher pay, another factor that could increase inflation. We’ll be monitoring this situation moving forward and are thankful it appears to have been resolved.

China’s Policy Support and Its Effect on Emerging Markets

We briefly mentioned in last week’s Investment Insights that China had undertaken serious measures to stimulate its economy, leading to a rally in Chinese equity markets. Today, we thought it would be useful to discuss what has led to this stimulus.Over the last few years, the Chinese economy has been sluggish, due in part to its slower recovery from COVID-19 but also because of the collapse of its housing sector. The latter made headlines in late 2021 when Chinese property giant Evergrande started to miss interest payments, a slippery slope that ultimately led to its default last year.

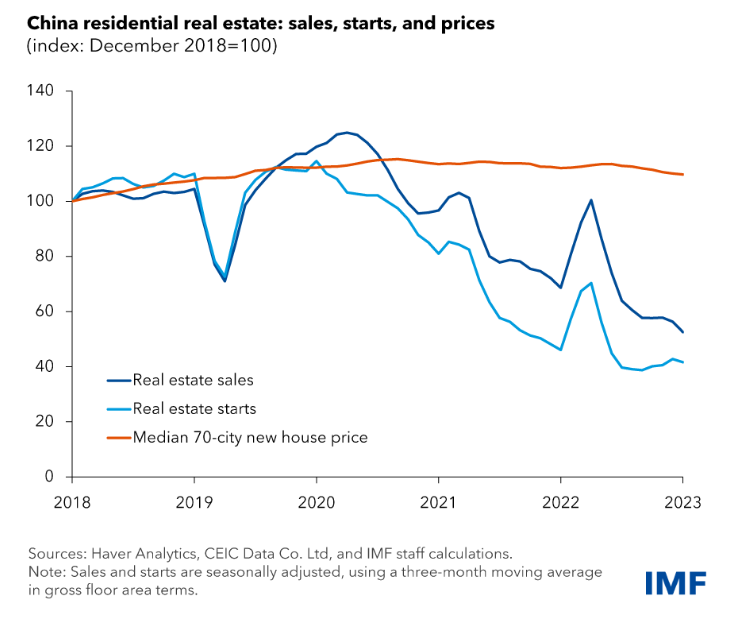

The situation was not dissimilar to the U.S. housing crisis of 2008, but the scale was substantially larger. In 2021, it was discovered that Evergrande would sell new developments to fund the construction of previous developments—a common Ponzi scheme. The below chart from the International Monetary Fund shows the dramatic change in property development since these issues began. Note that the orange line, which represents housing prices, has barely moved even as sales and starts have dramatically decreased.

To put China’s real estate market into perspective, Stanford’s Center on China’s Economy and Institutions wrote in December 2022 that the real estate sector “remained around 26% of GDP since 2018.” During the U.S. housing crisis, the real estate sector peaked at ~19%, according to the National Association of Homebuilders, and has hovered around 15% since then. Another striking statistic: over 70% of household savings in China are parked in real estate.

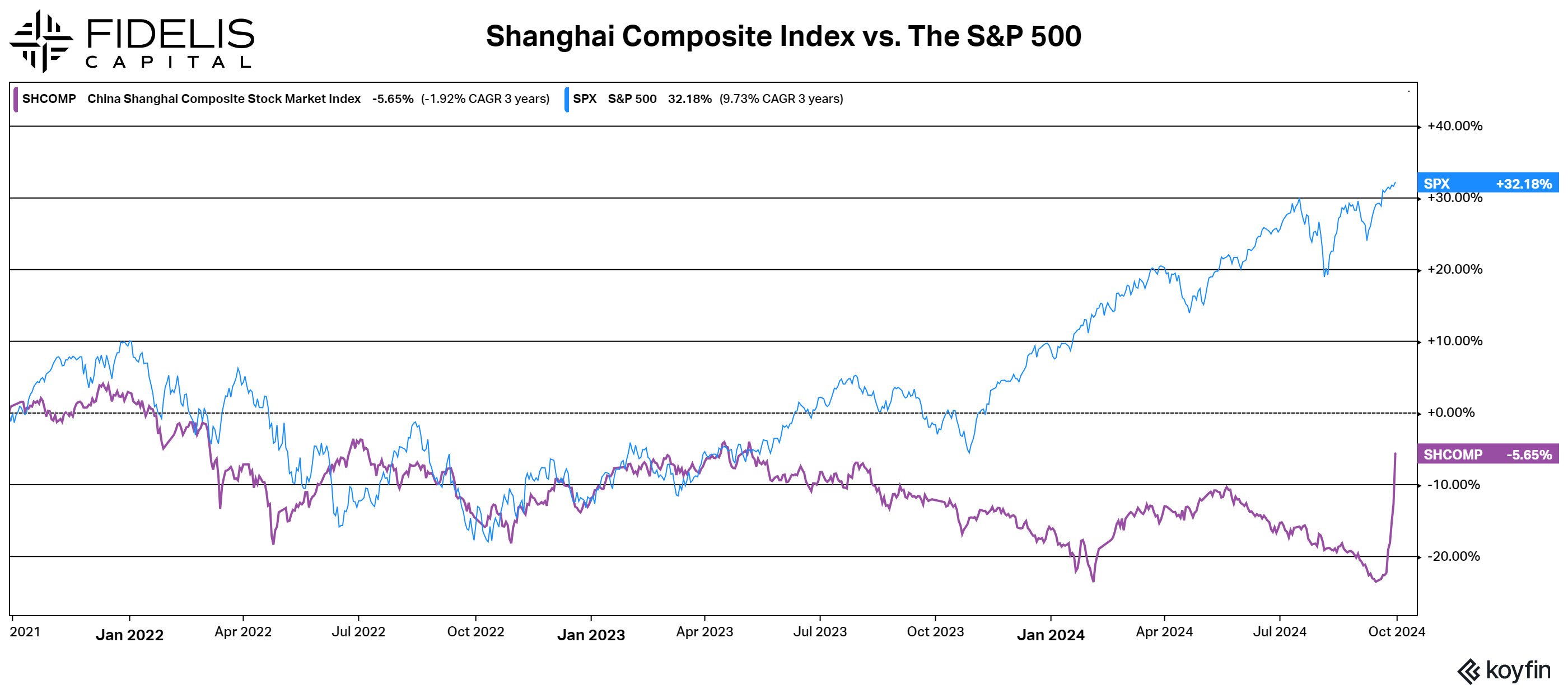

It should come as no surprise that a weak real estate sector has had a negative impact on the Chinese economy over the last few years. See the three-year performance chart of the Shanghai Composite Index versus the S&P 500 below. Even with the historical turnaround we’ve seen over the last few trading days, China’s stock market has significantly lagged the U.S.

After a dormant few years, this is the first signal that the Chinese economy may be at the beginning of a rebound. As the U.S. appears to be headed for a soft landing, improving conditions in China could lead to another bout of synchronized global growth. We’re watching closely as these themes unfold.